Understanding 4 main financial accounting reports?

This is a financial report tutorial meant to help create an understanding of the basics of accounting reports! Understanding the fundamentals of financial reporting is critical in today’s fast-paced financial world, whether you’re establishing a business, investing in the stock market, or simply want to improve your financial knowledge. This tutorial provides straightforward explanations and practical advice to help you understand the details of financial statements.

What are Financial Reports?

Financial reports, commonly known as financial statements, are formal records of a company’s financial activities. They provide insights into a company’s operations, financial position, and cash flows. These are crucial for stakeholders, including investors, creditors, and regulatory agencies, to make informed decisions, commonly known as the users of financial reports.

The Big Three of Financial Reports

- Balance Sheets – Statement of Financial Position

- Income Statements – Statement of Financial Performance

- Cash Flow Statements

For purposes of this guide, we will use Amazon’s 2022 financial statements as the guide.

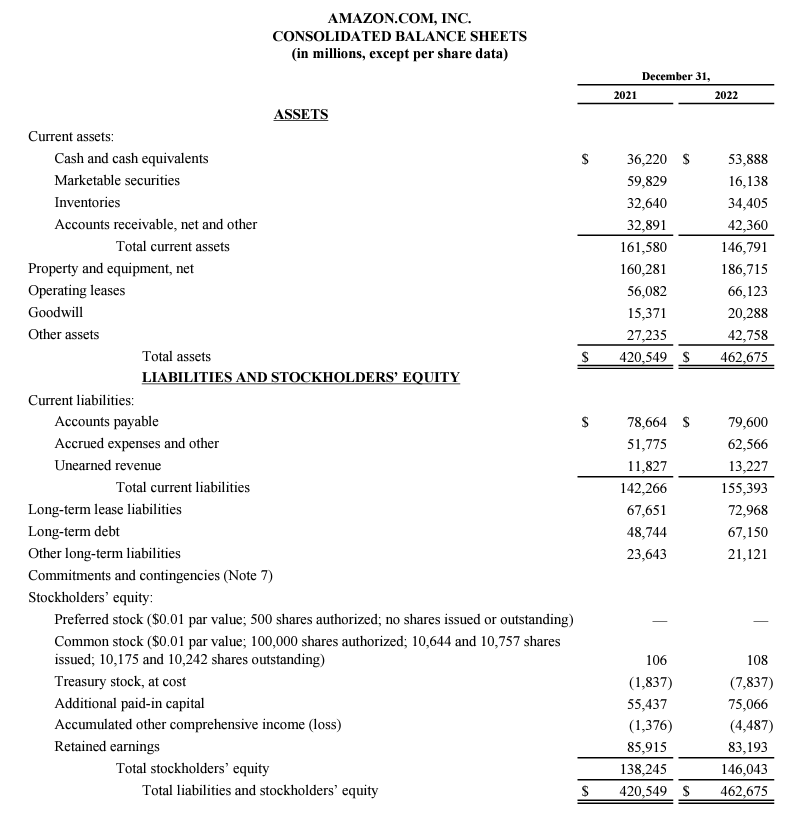

1. Balance Sheets

The balance sheet reflects a company’s financial status at a specific point in time. It’s structured around a simple equation: Assets = Liabilities + Equity.

Key Components:

- Assets: These are resources owned by the company that provide future economic benefits. Assets are classified as either current (cash, inventory) or non-current (property, equipment).

- Liabilities: These are obligations the company owes to others, including loans, mortgages, and accounts payable.

- Equity: Also known as shareholders’ equity, this represents the residual interest in the assets of the company after deducting liabilities.

Reading a Balance Sheet: See more on reading balance sheets here

- Current Ratio: This is a liquidity ratio that measures a company’s ability to pay short-term obligations.

- Debt to Equity Ratio: Indicates the proportion of equity and debt used to finance the company’s assets.

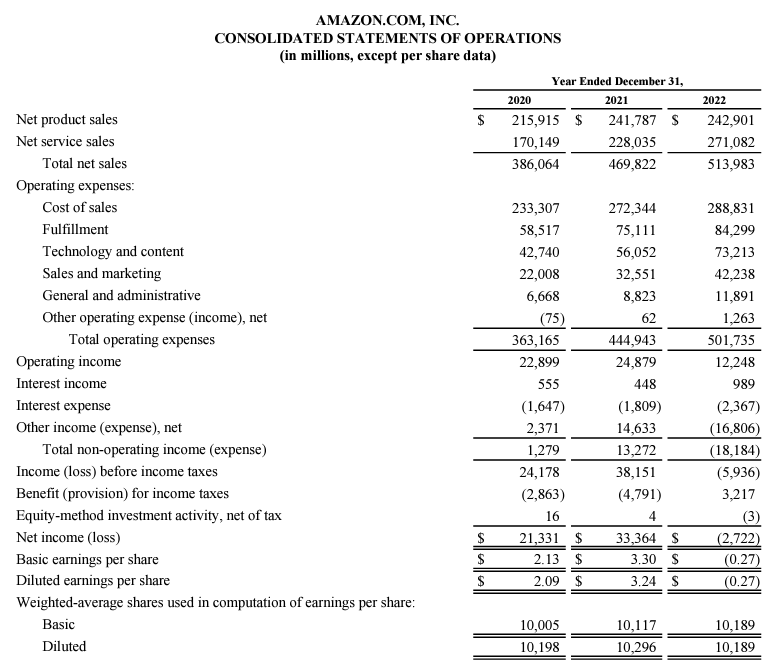

2. Income Statements: The Story of Profit and Loss

The income statement, or profit and loss statement, shows you a company’s financial performance over a period, typically a quarter or a fiscal year.

Key Elements:

- Revenue: The total income generated from sales of goods or services.

- Expenses: Costs incurred in the process of earning revenue, like salaries, rent, and utilities.

- Net Income: The final profit or loss after subtracting expenses from revenues.

Analyzing an Income Statement:

- Gross Profit Margin: Indicates the percentage of revenue that exceeds the cost of goods sold.

- Operating Margin: A measure of what proportion of a company’s revenue is left over after paying for variable costs of production.

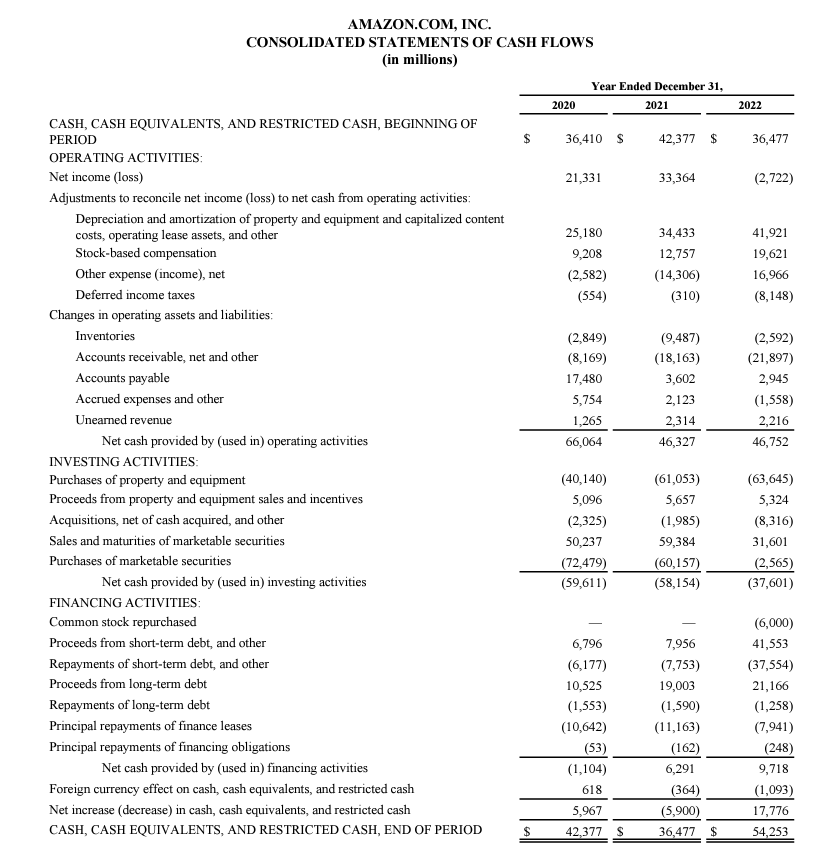

3. Cash Flow Statements: The Movement of Cash

This statement tracks the flow of cash in and out of a business over a specific period. It’s divided into three parts: operating activities, investing activities, and financing activities.

Sections Explained:

- Operating Activities: Cash generated or spent on day-to-day operations. For example, the cash flow provided/generated from the operating activities of Amazon in 2022 was 46,472 million.

- Investing Activities: Cash flows from the purchase or sale of assets, like equipment or investments.

- Financing Activities: Cash flows related to borrowing, repaying debts, or raising capital.

Cash Flow Analysis:

- Free Cash Flow: Represents the cash a company generates after accounting for cash outflows to support operations and maintain capital assets.

Enhancing Your Financial Literacy

Understanding financial reports is a journey. Here are some steps to deepen your knowledge:

- Engage with Online Resources: Many websites and online courses offer interactive learning experiences. Our resources page has a lot of information that has been helpful for many students.

- Attend Workshops or Seminars: These can provide valuable insights and networking opportunities.

- Consult with Financial Experts: If possible, discuss financial reports with a mentor or financial accounting tutor. We offer a free 20-minute financial accounting introductory lesson to get to know your requirements.

Conclusion

Financial reports might look like just numbers, but they’re really a company’s story in money terms. Learning to read them is like gaining a superpower for making smart choices in investing, running a business, or just boosting your money smarts. If it seems tricky at first, no worries – everyone starts somewhere! Stay curious and keep learning, and you’ll get the hang of it in no time. Need a hand? You can always book a tutoring session to learn more about financial statements.

"Are you tired of struggling in accounting class? Let us make accounting easy and enjoyable for you."