What is an Income Statement?

An income statement is a financial report that tells the story of a company’s financial performance over a certain time, like a movie that shows a company’s journey from start to finish within a fiscal period. It’s more than just a table of numbers; it’s a narrative about what the company earns (revenues), what it spends (expenses), and the final outcome (profit or loss). At the end of this, you will see an income statement example and see how to access more resources on the same.

Importance of an Income Statements

Imagine a business as a complex machine, in that case, the income statement is like a dashboard that gives you an overview of how well this machine is working. Here’s why it’s so crucial:

- Understanding Profitability: The primary role of an income statement is to reveal whether a company is making money. This is done by subtracting expenses from revenues to find out the net profit or loss.

- Expense Tracking: It’s not just about the earnings; it’s also about understanding where the money is going. This statement breaks down various costs, helping identify areas where the company spends most.

- Growth Insights: By comparing income statements from different periods, you can see how the company is evolving. Is it growing? Is it facing more expenses? These trends are vital for future planning.

Users of Income Statements and Why?

Income statements are not just for accountants or financial experts. They are crucial for a broad audience:

- Investors and Shareholders: These folks look at income statements to decide whether to buy, hold, or sell stocks. They want to know if their investment is growing.

- Creditors and Lenders: Banks and financial institutions check these statements before giving out loans. They want to ensure that the company can pay back.

- Company Management and Boards: Leaders and decision-makers use these reports to strategize and steer the company in the right direction.

- Regulatory Bodies: Government and tax agencies review these statements for compliance and taxation purposes.

- Financial Analysts and Economists: They use this information to forecast economic trends and advise clients.

In a nutshell, an income statement is like a financial map of a company. It’s essential for anyone who’s involved or interested in understanding a business’s financial health and trajectory. Our guide on the users of financial statements will help you get a better understanding.

Components of an Income Statement

Revenue/Sales

The starting point of an income statement is revenue, also known as sales. This is the total amount of money the company brings in from its business activities, like selling products or services, before any expenses are deducted.

- Gross Revenue: This is the raw figure that shows total sales. Think of it as the full amount of sales receipts.

- Net Revenue: It’s gross revenue minus returns, discounts, and allowances. This number gives a more accurate picture of the actual money earned.

Cost of Goods Sold (COGS)

Next, we look at the Cost of Goods Sold (COGS). This is what it costs the company to produce the goods or services it sells.

- Direct Costs: COGS includes direct costs like materials and labor directly involved in creating the product.

- Impact on Gross Profit: Subtracting COGS from net revenue gives us the gross profit. It’s an essential figure because it shows how efficient a company is at managing production costs relative to its revenue.

Operating Expenses

After gross profit, we have operating expenses. These are costs related to running the company that aren’t directly tied to producing goods or services yet they remain crucial for the daily operations of the business to continue.

- Types of Expenses: Common operating expenses include salaries for office staff, rent for office space, and utilities. They are often categorized into selling expenses, general expenses, and administrative expenses (SG&A).

- Effect on Income: Operating expenses are subtracted from gross profit. This calculation tells us how much money the company makes from its core business operations.

Operating Income

Operating income is the profit a company makes from its regular business operations, excluding any non-operating income or expenses.

- Calculation: It’s calculated by subtracting operating expenses from gross profit. This number is crucial as it shows the profitability of the company’s core business activities.

Non-Operating Items

These are revenues and expenses not related to the core business operations. They include things like interest income, interest expenses, gains or losses from investments or asset sales, and unusual or one-time expenses.

Net Income

Finally, we arrive at net income, the famous “bottom line.” It’s the final profit or loss after all revenues and expenses (including non-operating items and taxes) are accounted for.

- Indicator of Overall Profitability: Net income is a crucial indicator of the company’s overall profitability. It’s the number that gets reported in the headlines and closely watched by investors and analysts.

Understanding these components is like learning to read a financial story. Each part adds a chapter to the company’s fiscal narrative, providing a comprehensive view of its financial health and performance.

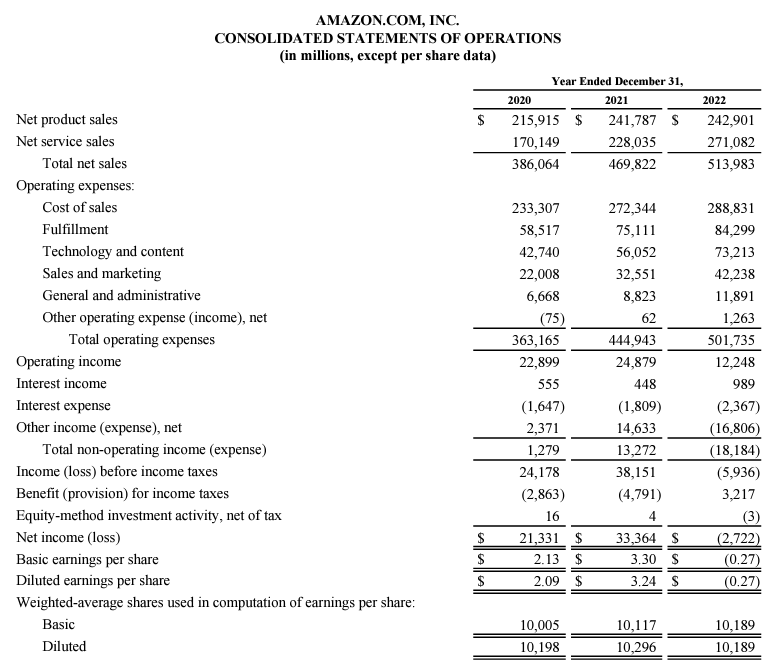

Here is an income statement Example:

In our guide Analysis of Income Statement, we look at an income statement example and go ahead to analyze it.

"Are you tired of struggling in accounting class? Let us make accounting easy and enjoyable for you."