TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Task

File the tax returns based on Tax Scenario & Facts, W-2 (Wage and Tax Statement) provided below.

Please note:

- Open each tab and review the scenarios and forms before beginning.

- Each forms are not linked, but may be helpful in understanding and accurately completing the assessment.

- Enter values as plain text. For Ex: if the value is 11,000 – Enter it as 11000.

- For SSN, follow same format as mentioned in the Tax Scenario & Facts.

- Each page of the form is provided with button to view Question Text (i.e Tax Scenario & Facts) and W-2 (Wage and Tax Statement).

| Taxpayer | Spouse | Dependent | |

| Information | Information | Information | |

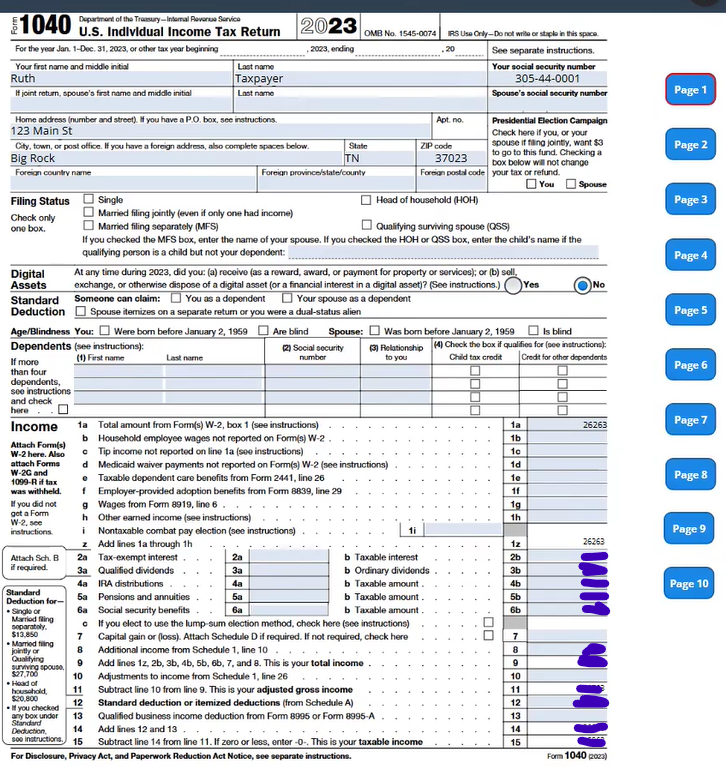

| Name | Ruth Taxpayer | Henry Taxpayer | Amy Taxpayer |

| Address | 123 Main St. Big Rock, TN 37023 | Unknown | 123 Main St. Big Rock, TN 37023 |

| Marital Status | Married | Married | Single |

| SSN | 305-44-0001 | 305-44-0002 | 305-44-0003 |

| DOB | 05-11-1975 | 05-11-1970 | 01-01-2020 |

| Occupation | Store Clerk | Construction worker | |

| Daytime Telephone | (650) 555-1234 |

Henry and Ruth are having marital issues and have decided to get a divorce. Henry did not live with the taxpayer at any time in the 2023 tax year, and they didn’t communicate; they are still married as of 12/31/2023.

Taxpayer did not serve in the Military. The taxpayer lived in TN all year. Ruth has provided more than half of the support of her dependent child and paid more than half of the cost to run her home in 2023.

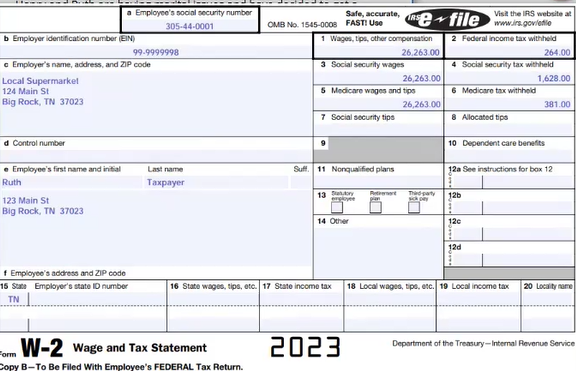

Ruth Earned $26.263.00 in taxable income from her job in 2023. Her spouse is a construction worker. Ruth also made $500 in taxable interest from a savings account with her local bank.

Ruth has no itemized deductions. No foreign assets or accounts, No crypto.

Ruth has marketplace insurance. She is the only one insured with the

marketplace, her dependent is not part of the marketplace insurance.

Amy lived with Ruth for 210 nights.

If any facts are missing, please assume they do not apply to the taxpayer.

She paid $6,000 for Amy’s daycare to:

Big Rock elementary school

130 Main St

Big Rock TN 37023

EIN 99-99999992

W-2 statement : Click Here

1099-INT : Click Here

1095-A : Click Here

Helpful Links:

https://www.irs.gov/

https://www.irs.gov/pub/irs-prior/p17 — 2023.pdf

Use the following link (IRS Earned Income Credit Table) to Calculate the Earned Income Credit for the taxpayer (Form 1040, Line 27): https://www.irs.gov/pub/irs-prior/i1040tt-2023.pdf

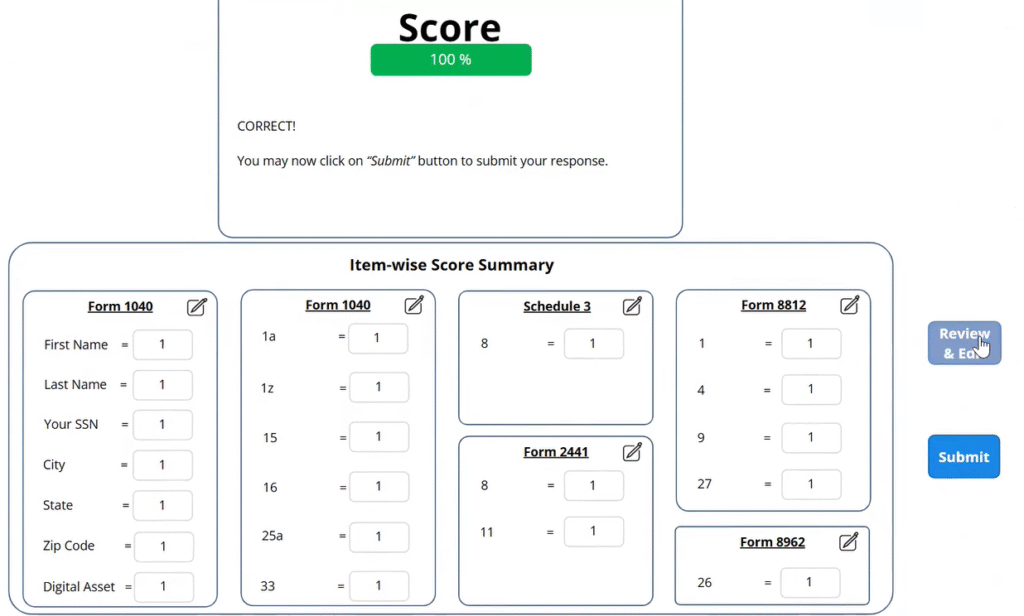

Solution – Ruth Taxpayer – Henry and Ruth are having marital issues

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.