TR 23.4 Ruth Taxpayer

Task

File the tax returns based on Tax Scenario & Facts, Form W2, 1099-DIV and 1099-INT provided below.

Please note:

Open each tab and review the scenarios and forms before beginning.

Each forms are not linked, but may be helpful in understanding and accurately completing the assessment.

Enter values as plain text. For Ex: if the value is 11,000 – Enter it as 11000.

For SSN, follow same format as mentioned in the Tax Scenario & Facts.

Each page of the form is provided with button to view Question Text (i.e. Tax Scenario & Facts) and W-2 (Wage and Tax Statement), 1098-E, 1099-Div, 1099-INT.

Tax Scenario & Facts:

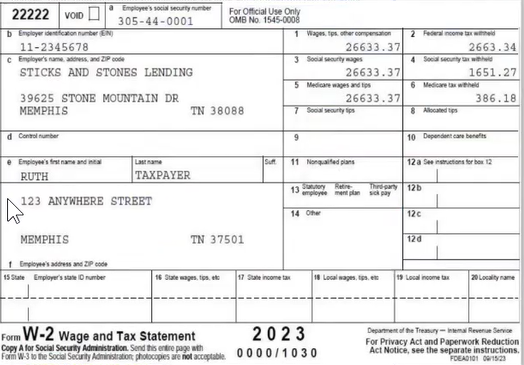

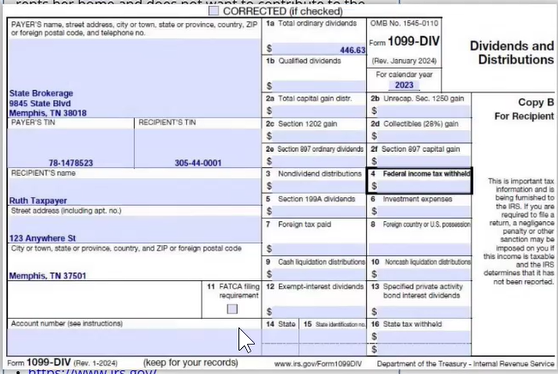

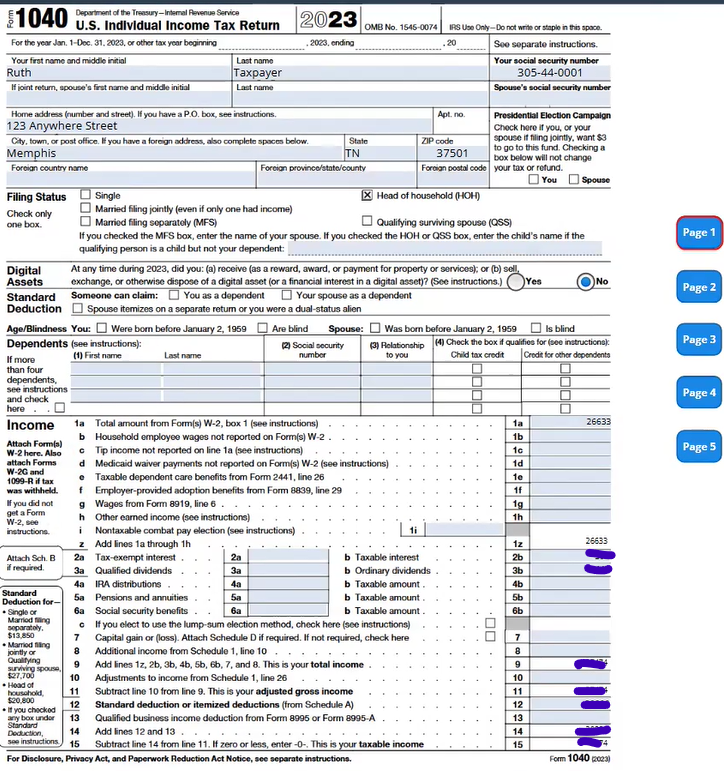

Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending. Ruth has been divorced from her husband since 2021 and has a 6-year-old daughter named Janet. Ruth and her daughter Janet have lived in TN all year. Ruth’s ex-husband will not claim Janet on his tax return. Ruth does not own any digital assets. She rents her home and does not want to contribute to the Presidential Election Campaign. Your assignment is to accurately prepare the federal income tax return, Form 1040, for the year that ended December 31, 2023.

| Name | DOB SSN Occupation | Address |

| Ruth Taxpayer Janet Taxpayer | 7-14-1990 305-44-0001 Loan Officer 1-25-2017 305-44-0002 . | 123 Anywhere St Memphis, TN 37501 |

Helpful Links:

. https://www.irs.gov/

. https://www.irs.gov/pub/irs-prior/p17 — 2023.pdf

Use the following link (IRS Earned Income Credit Table) to Calculate the Earned Income Credit for the taxpayer (Form 1040, Line 27): https://www.irs.gov/pub/irs-prior/i1040tt — 2023.pdf

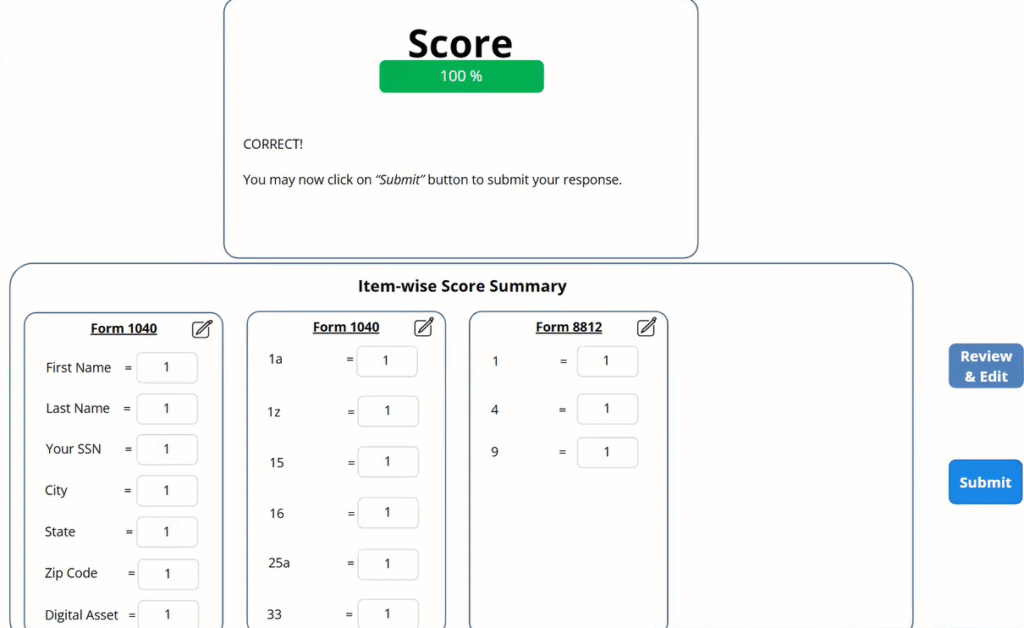

Solution

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.