Lansing Company’s current-year income statement and selected balance sheet data at December 31 of the current and prior years follow.

| LANSING COMPANY | |||||

| Income Statement | |||||

| For Current Year Ended December 31 | |||||

| Sales revenue | $ 154,200 | ||||

|---|---|---|---|---|---|

| Expenses | |||||

| Cost of goods sold | 61,000 | ||||

| Depreciation expense | 21,500 | ||||

| Salaries expense | 37,000 | ||||

| Rent expense | 10,900 | ||||

| Insurance expense | 5,700 | ||||

| Interest expense | 5,500 | ||||

| Utilities expense | 4,700 | ||||

| Net income | $ 7,900 | ||||

| LANSING COMPANY | ||

| Selected Balance Sheet Accounts | ||

| At December 31 | Current Year | Prior Year |

|---|---|---|

| Accounts receivable | $ 7,500 | $ 9,600 |

| Inventory | 3,880 | 2,490 |

| Accounts payable | 6,300 | 8,400 |

| Salaries payable | 1,260 | 890 |

| Utilities payable | 600 | 350 |

| Prepaid insurance | 450 | 660 |

| Prepaid rent | 600 | 370 |

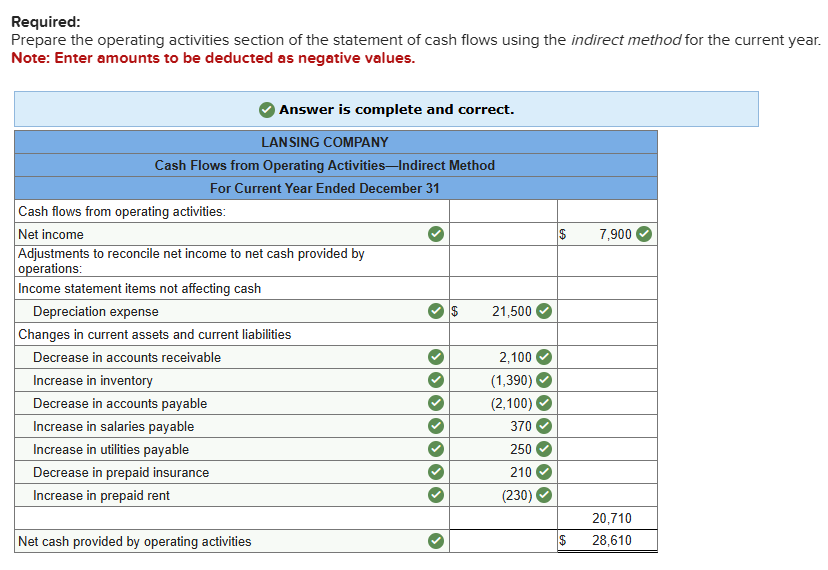

Required:

Prepare the operating activities section of the statement of cash flows using the indirect method for the current year.

Note: Enter amounts to be deducted as negative values.

Solution