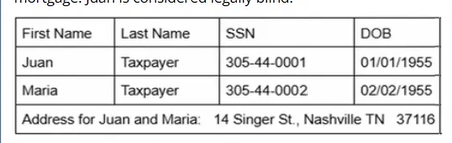

TR 23.5 Juan and Maria Taxpayer

Task

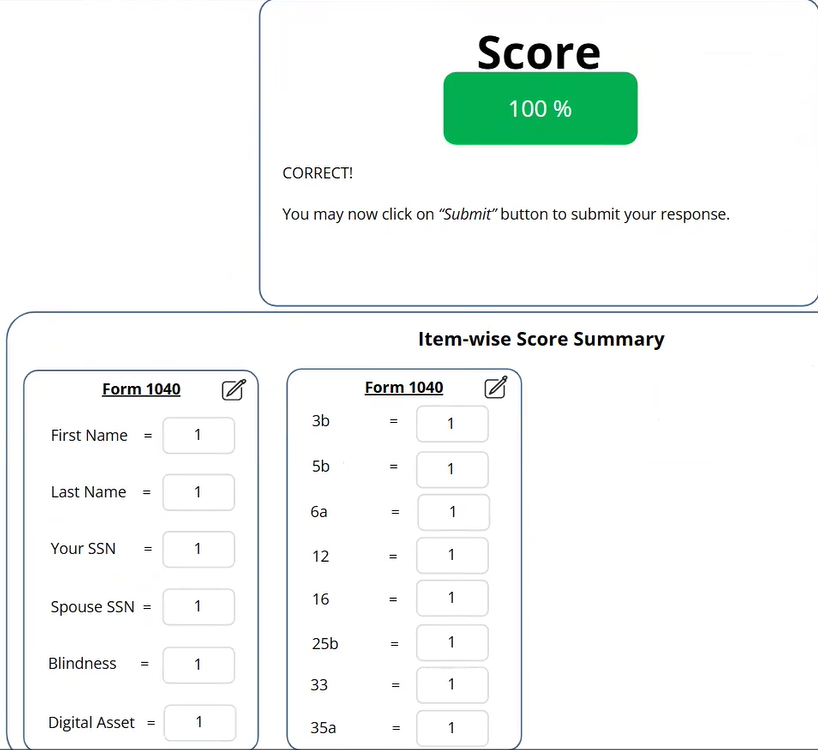

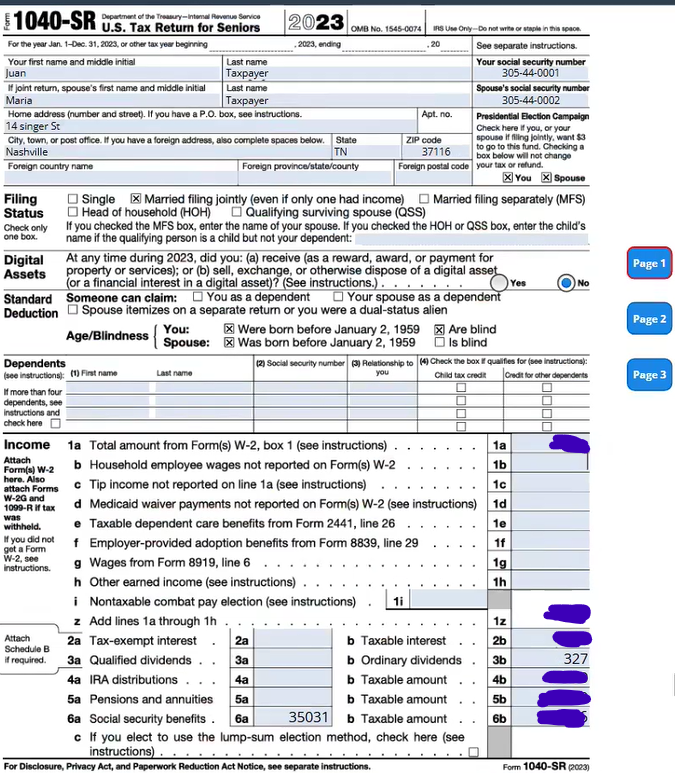

File the tax returns based on Tax Scenario & Facts, Form 1099-INT, Form SSA-1099-SM, Form 1099-DIV, Form 1099-R, Standard Deduction Chart provided below.

Tax Scenario & Facts:

Juan and Maria Taxpayer are a retired couple who live in Nashville, TN. They own their home, and do not have a mortgage. Juan is considered legally blind.

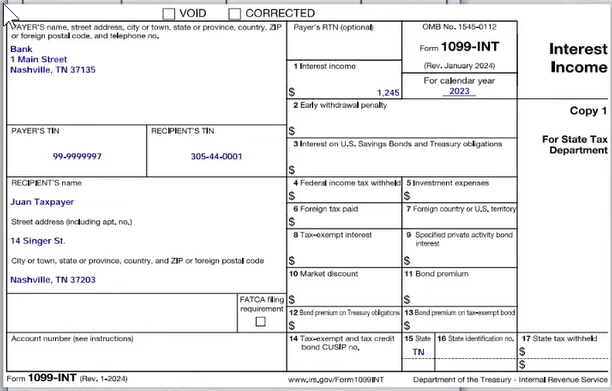

Juan and Maria have interest from their savings, and purchased stock in the past year that pays a dividend.

In addition:

- Maria has a pension from her work as a county librarian

- Juan has an RMD from a traditional IRA.

- Both Juan and Maria have Social Security Income.

- Both would like to contribute to the Presidential Campaign Fund

- Neither owns any digital assets, and have not had a disaster distribution.

Solution – Juan and Maria Taxpayer are a retired couple who live in Nashville, TN

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.