Tax Scenario & Facts

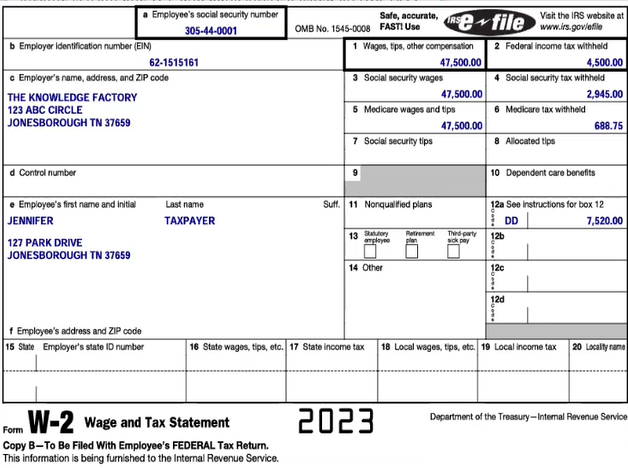

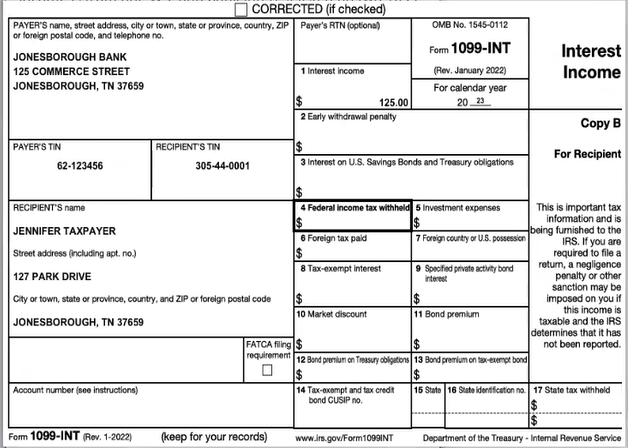

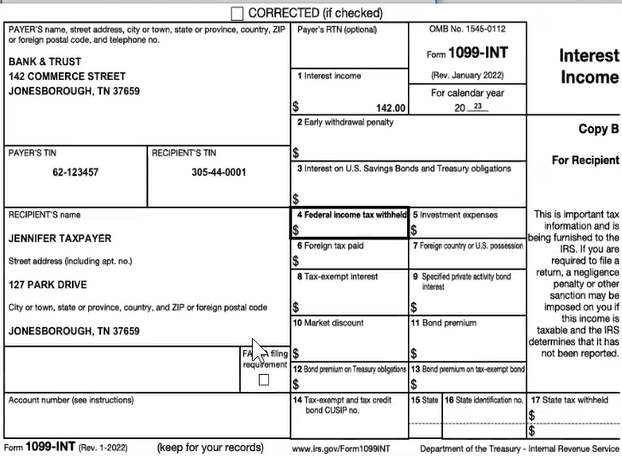

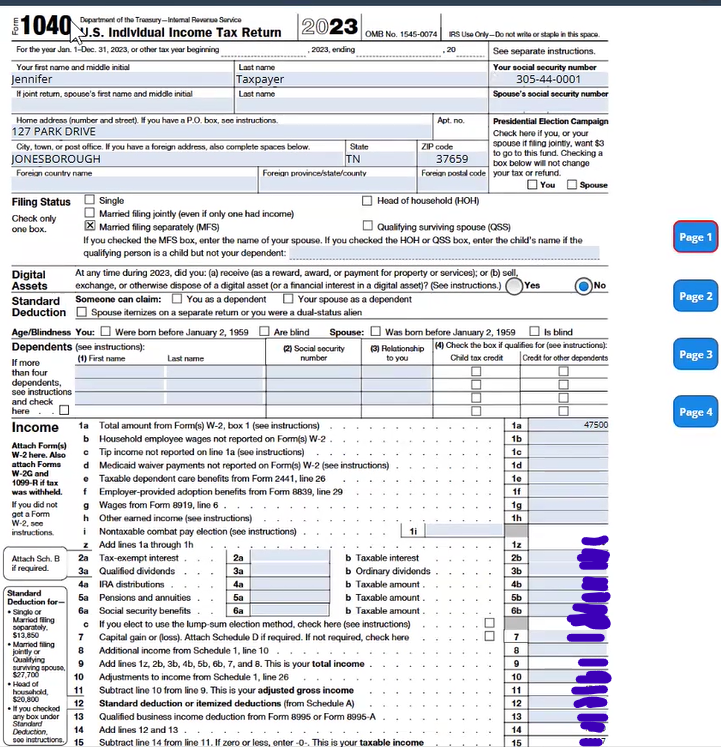

Jennifer Taxpayer needs you to prepare her 2023 1040 tax return. She is an elementary school teacher at a private school in Tennessee. She is married to her husband Parnel and they wish to file married filing separately. Her only income is from one W-2 and bank interest listed on two 1099-INTs. Jennifer and Parnel both wish to use the standard deduction. Jennifer spent $525 of her own money on supplies

for her job as a teacher. Jennifer had no digital asset transactions during 2023. Please help Jennifer by preparing her 2023 individual income tax return based on this information along with her personal information below as well as the tax forms she received.

| Name | DOB SSN | Address |

| Jennifer Taxpayer | 10-02-1985 305-44-0001 | 127 PARK DRIVE JONESBOROUGH, TN 37659 |

| Parnel Taxpayer | 305-44-0002 | 127 PARK DRIVE JONESBOROUGH, TN 37659 |

W-2 statement : Click Here

1099-INT (Jonesborough Bank) : Click Here

1099-INT (Bank & Trust) : Click Here

Helpful Links:

. https://www.irs.gov/

. https://www.irs.gov/pub/irs-prior/p17-2023.pdf

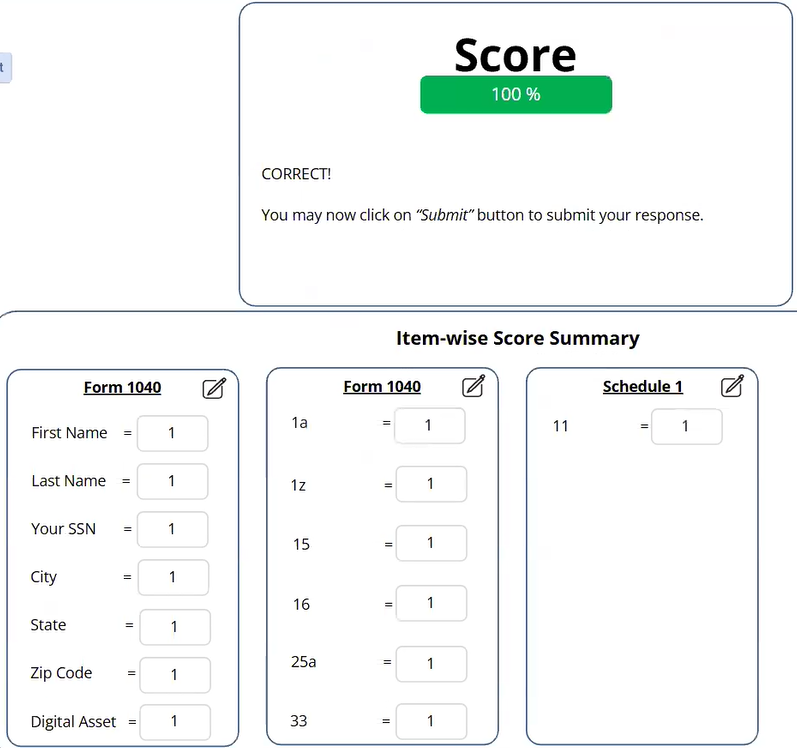

Solution – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Here is a snippet of the correct answer

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.