Forten Company’s current year income statement, comparative balance sheets, and additional information follow. For the year,

- (1) all sales are credit sales,

- (2) all credits to Accounts Receivable reflect cash receipts from customers,

- (3) all purchases of inventory are on credit, and

- (4) all debits to Accounts Payable reflect cash payments for inventory.

| FORTEN COMPANY | ||

| Income Statement | ||

| For Current Year Ended December 31 | ||

| Sales | $ 622,500 | |

|---|---|---|

| Cost of goods sold | 293,000 | |

| Gross profit | 329,500 | |

| Operating expenses (excluding depreciation) | $ 140,400 | |

| Depreciation expense | 28,750 | 169,150 |

| Other gains (losses) | ||

| Loss on sale of equipment | (13,125) | |

| Income before taxes | 147,225 | |

| Income taxes expense | 35,450 | |

| Net income | $ 111,775 | |

| FORTEN COMPANY | ||

| Comparative Balance Sheets | ||

| December 31 | ||

| Current Year | Prior Year | |

|---|---|---|

| Assets | ||

| Cash | $ 61,900 | $ 81,500 |

| Accounts receivable | 77,850 | 58,625 |

| Inventory | 287,656 | 259,800 |

| Prepaid expenses | 1,290 | 2,055 |

| Total current assets | 428,696 | 401,980 |

| Equipment | 149,500 | 116,000 |

| Accumulated depreciation—Equipment | (40,625) | (50,000) |

| Total assets | $ 537,571 | $ 467,980 |

| Liabilities and Equity | ||

| Accounts payable | $ 61,141 | $ 126,675 |

| Long-term notes payable | 73,400 | 64,350 |

| Total liabilities | 134,541 | 191,025 |

| Equity | ||

| Common stock, $5 par value | 174,750 | 158,250 |

| Paid-in capital in excess of par, common stock | 49,500 | 0 |

| Retained earnings | 178,780 | 118,705 |

| Total equity | 403,030 | 276,955 |

| Total liabilities and equity | $ 537,571 | $ 467,980 |

Additional Information on Current Year Transactions

- The loss on the cash sale of equipment was $13,125 (details in b).

- Sold equipment costing $70,875, with accumulated depreciation of $38,125, for $19,625 cash.

- Purchased equipment costing $104,375 by paying $46,000 cash and signing a long-term notes payable for the balance.

- Paid $49,325 cash to reduce the long-term notes payable.

- Issued 3,300 shares of common stock for $20 cash per share.

- Declared and paid cash dividends of $51,700.

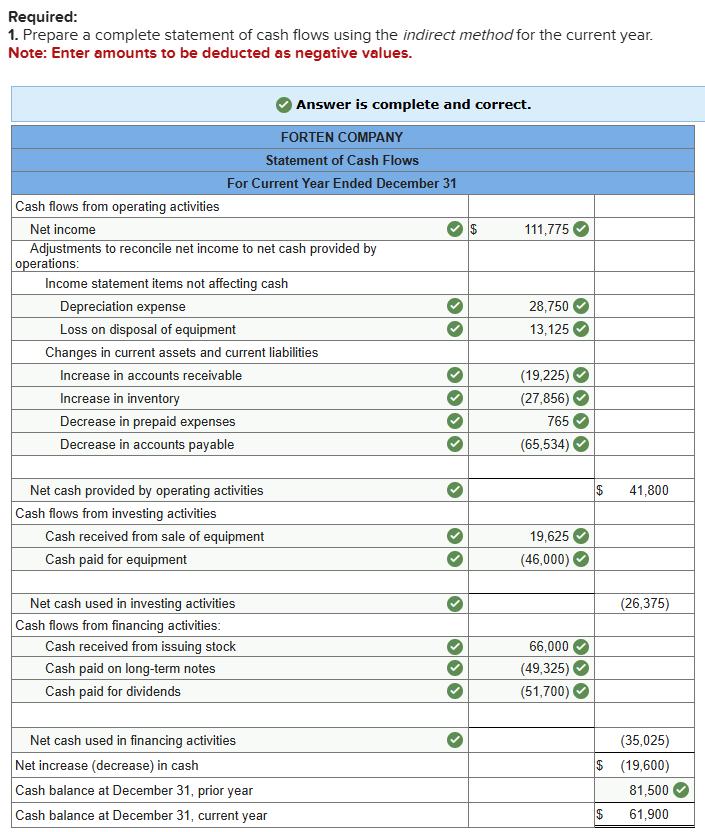

Required:

1. Prepare a complete statement of cash flows using the indirect method for the current year.

2. Prepare a complete statement of cash flows using a spreadsheet using the indirect method.

Note: Enter all amounts as positive values.

Note: Enter amounts to be deducted as negative values.

Solution – Forten Company’s current year income statement