Meaning of Activity Ratios

Activity ratios are also known as asset management ratios, they measure how efficiently a company is using its assets to generate sales. These ratios help determine if the amount of each type of asset is reasonable, too high, or too low in view of current and projected sales.

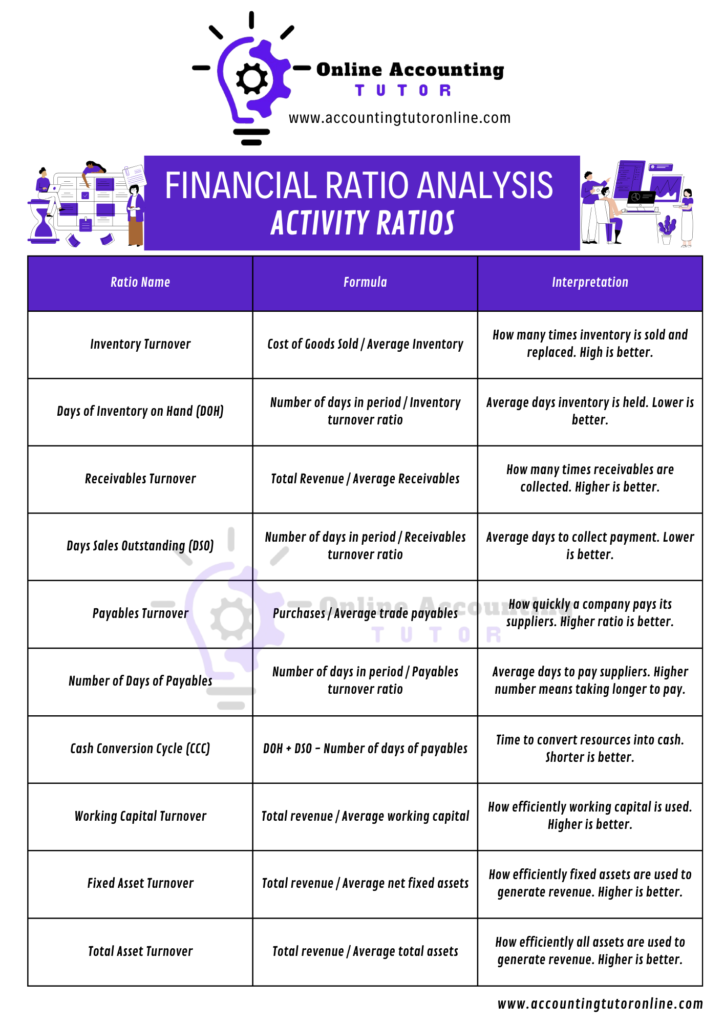

Below we show each activity ratio, its formula, interpretation, and any other considerations worth noting.

See our detailed analysis on What is liquidity ratio in Accounting

Receivables Turnover Ratio

Formula

Total revenue / Average receivables

Interpretation

This ratio indicates how many times a company collects its average accounts receivable during a specific period. A higher turnover ratio suggests that a company is efficient in collecting its receivables, which means that it’s not tying up a lot of cash in outstanding customer payments.

Considerations

A very high ratio could indicate a strict credit policy that may discourage sales. A low ratio might indicate a company is having difficulty collecting its receivables, or that its credit policies are too loose.

Days of Sales Outstanding (DSO)

Formula

Number of days in period / Receivables turnover ratio

Interpretation

DSO, also called the average collection period, measures the average number of days it takes for a company to collect payment after a sale. A lower DSO indicates a company is quicker in collecting its receivables and has more cash available for other purposes.

Considerations

A high DSO can signal issues with a company’s credit policy, collection process, or customers’ financial health. Comparing the DSO to industry averages can provide insight into whether a company is performing well or not. For example, a DSO of 46 days should alert an analyst to dig deeper to find out why customers may be paying late.

Inventory Turnover Ratio

Formula

Cost of goods sold / Average inventory

Interpretation

This ratio measures how many times a company sells and replaces its inventory during a specific period. A high inventory turnover ratio suggests efficient inventory management, indicating that a company is quickly selling its goods.

Considerations

A low turnover might indicate overstocking, slow sales, or potentially obsolete goods. It is important to know whether a company uses cost of goods sold or sales in the numerator. If sales are used, it might overstate the true turnover.

Days of Inventory on Hand (DOH)

Formula

Number of days in period / Inventory turnover ratio

Interpretation

DOH indicates the average number of days a company holds its inventory before selling it. A lower DOH is generally preferred because it indicates that inventory is quickly moving through the company.

Considerations

A high DOH can indicate issues with sales or excess inventory, which can be costly to store and may become obsolete. It is important to note that inventory can be valued by different methods and these methods may affect the value on the balance sheet and the cost of goods sold.

Payables Turnover Ratio

Formula

Purchases / Average trade payables

Interpretation

This ratio measures how many times a company pays its suppliers during a specific period. A higher payables turnover ratio suggests that a company is paying its suppliers quickly.

Considerations

A very high ratio may indicate that the company is not taking advantage of the credit terms offered by its suppliers. A low ratio might indicate cash flow problems, or that the company is taking too long to pay suppliers.

Number of Days of Payables

Formula

Number of days in period / Payables turnover ratio

Interpretation

This metric indicates the average number of days it takes a company to pay its suppliers. A higher number of days means a company is taking longer to pay its suppliers, which can help the company conserve cash.

Considerations

An excessively high number of days of payables can indicate financial distress or the company may be damaging its relationship with its suppliers.

Cash Conversion Cycle (Net Operating Cycle)

Formula

DOH + DSO – Number of days of payables

Interpretation

The cash conversion cycle (CCC) measures the time it takes for a company to convert its investments in inventory and other resources into cash. A shorter CCC means a company is more efficient in managing its working capital.

Considerations

A longer CCC could indicate inefficiencies in the operating cycle, and a company should aim to shorten its CCC.

Working Capital Turnover Ratio

Formula

Total revenue / Average working capital

Interpretation

This ratio shows how efficiently a company is using its working capital to generate sales. A higher turnover ratio indicates more efficient use of working capital.

Considerations

A very high turnover ratio can sometimes indicate that a company might be underfunded, or that it might be at risk of not being able to meet its short term obligations because of low levels of working capital. A low turnover ratio could indicate that a company is not using working capital efficiently, or it has too much working capital.

Fixed Asset Turnover Ratio

Formula

Total revenue / Average net fixed assets

Interpretation

This ratio measures how effectively a company is using its fixed assets to generate sales. A higher ratio suggests that a company is efficiently using its fixed assets, like plant and equipment, to produce sales.

Considerations

A low fixed asset turnover ratio can indicate that a company is not using its fixed assets efficiently or that it may have excess fixed assets. The age of a company’s assets can affect this ratio; older assets might be fully depreciated which would affect the fixed asset turnover ratio.

Total Asset Turnover Ratio

Formula

Total revenue / Average total assets

Interpretation

This ratio measures how efficiently a company uses all of its assets to generate sales. A higher ratio suggests that a company is effectively utilizing its assets to produce revenue.

Considerations

A low total asset turnover ratio may indicate that the company is not generating enough sales given its total assets . The total asset turnover ratio can be affected by current assets such as inventory and accounts receivable.

Key Considerations for All Activity Ratios

Industry Comparisons – It is important to compare a company’s activity ratios to industry averages to evaluate its performance relative to its peers. Industry averages can be found through resources like Value Line and Morningstar.

Trend Analysis – Analyzing a company’s activity ratios over time can reveal trends in its performance and highlight areas that need improvement.

Accounting Practices – Different accounting practices can affect how these ratios are calculated and interpreted.

Growth and Seasonality – Rapid growth or seasonal sales can distort comparisons of activity ratios.

Balance – When evaluating a company, it is important to analyze a full set of ratios, not just activity ratios to get a complete picture of the company’s financial health.

Frequently Asked Questions on Activity Ratios

What are activity ratios?

Activity ratios, also known as asset management ratios, measure how efficiently a company is using its assets to generate sales. They help determine if a company has a reasonable amount of each type of asset, given its sales.

Why are activity ratios important?

These ratios are important because when companies acquire assets, they must obtain capital, which is expensive. If a company has too many assets, its cost of capital will be too high, which will depress its profits. If assets are too low, profitable sales may be lost. Activity ratios help a company strike a balance between too many and too few assets.

What are the key activity ratios?

- The key activity ratios include:

- Receivables Turnover Ratio

- Days Sales Outstanding (DSO)

- Inventory Turnover Ratio

- Days of Inventory on Hand (DOH)

- Payables Turnover Ratio

- Number of Days of Payables

- Cash Conversion Cycle (CCC)

- Working Capital Turnover Ratio

- Fixed Asset Turnover Ratio

- Total Asset Turnover Ratio

How is the Receivables Turnover Ratio calculated, and what does it mean?

The Receivables Turnover Ratio is calculated as: Total Revenue / Average Receivables. It indicates how many times a company collects its average accounts receivable during a period. A higher ratio generally suggests efficient collection of receivables.

What is Days Sales Outstanding (DSO), and how is it interpreted?

DSO, also called the average collection period, is calculated as: Number of days in period / Receivables turnover ratio. It measures the average number of days it takes a company to collect payment after a sale. A lower DSO is generally preferred, indicating quicker collection of receivables. A high DSO could indicate problems with credit or collection policies.

What is the formula for the Inventory Turnover Ratio, and what does it indicate?

The Inventory Turnover Ratio is calculated as: Cost of goods sold / Average inventory. It measures how many times a company sells and replaces its inventory during a specific period. A high ratio indicates efficient inventory management. Note, however, that some sources may use sales in place of cost of goods sold in the numerator.

How is Days of Inventory on Hand (DOH) calculated, and what does it tell us?

DOH is calculated as: Number of days in period / Inventory turnover ratio. It indicates the average number of days a company holds its inventory before selling it. A lower DOH is preferred, indicating quick inventory movement.

How is the Payables Turnover Ratio calculated and interpreted?

The Payables Turnover Ratio is calculated as: Purchases / Average trade payables. A higher ratio suggests that a company is paying its suppliers quickly.

What is the Number of Days of Payables, and how is it useful?

The Number of Days of Payables is calculated as: Number of days in period / Payables turnover ratio. It indicates the average number of days it takes a company to pay its suppliers. A higher number means a company is taking longer to pay its suppliers.

What is the Cash Conversion Cycle (CCC)?

The CCC is calculated as: DOH + DSO – Number of days of payables. It measures the time it takes for a company to convert its investments in inventory and other resources into cash. A shorter CCC is generally preferred.

How is the Working Capital Turnover Ratio calculated and what does it signify?

The Working Capital Turnover Ratio is calculated as: Total revenue / Average working capital. A higher ratio indicates more efficient use of working capital.

What is the Fixed Asset Turnover Ratio, and how is it calculated?

The Fixed Asset Turnover Ratio is calculated as: Total revenue / Average net fixed assets. A higher ratio indicates that a company is efficiently using its fixed assets to generate revenue.

What does the Total Asset Turnover Ratio measure?

The Total Asset Turnover Ratio is calculated as: Total revenue / Average total assets. A higher ratio indicates that a company is effectively utilizing all of its assets to generate revenue.

What are some key considerations when analyzing activity ratios?

Key considerations when interprating the ratios include:

- Industry Comparisons: Compare a company’s ratios to industry averages.

- Trend Analysis: Analyze ratios over time to identify trends.

- Accounting Practices: Be aware of how different accounting practices can affect ratios.

- Growth and Seasonality: Consider how rapid growth or seasonal sales might distort ratios.

- Look at a full set of ratios: Evaluate activity ratios as part of a complete analysis of a company’s financials.

Where can I find industry average data for comparison?

Industry average data can be obtained from online resources such as Google Finance, Yahoo Finance, Value Line, and Morningstar.

Can activity ratios be used in financial planning and forecasting?

Yes, activity ratios such as the total assets turnover ratio can be used in financial planning and forecasting. For instance, if key ratios are expected to remain constant, the Additional Funds Needed (AFN) equation can be used to forecast the need for external funds.

"Are you tired of struggling in accounting class? Let us make accounting easy and enjoyable for you."