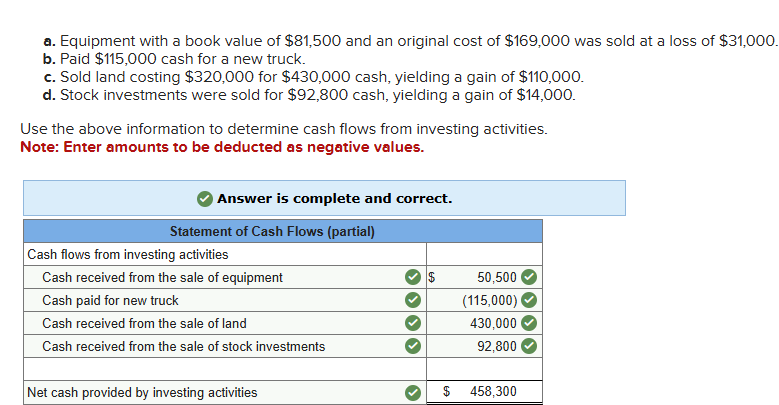

- Equipment with a book value of $81,500 and an original cost of $169,000 was sold at a loss of $31,000.

- Paid $115,000 cash for a new truck.

- Sold land costing $320,000 for $430,000 cash, yielding a gain of $110,000.

- Stock investments were sold for $92,800 cash, yielding a gain of $14,000.

Use the above information to determine cash flows from investing activities.

Note: Enter amounts to be deducted as negative values.

Solution – Cash flows from investing activities