TR 23.9 Tony Taxpayer

Task

File the tax returns based on Tax Scenario & Facts, Form W2 provided below.

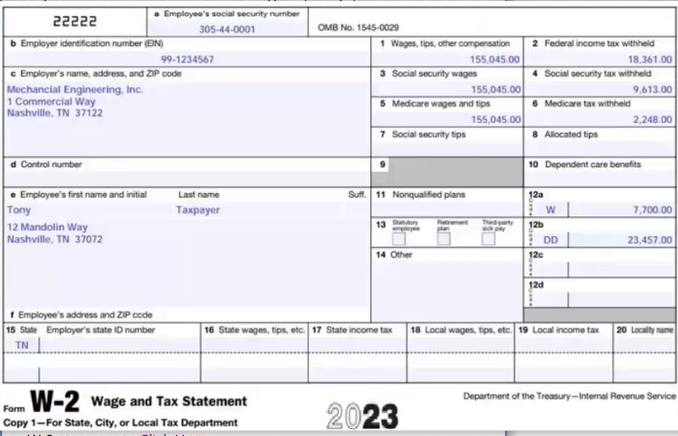

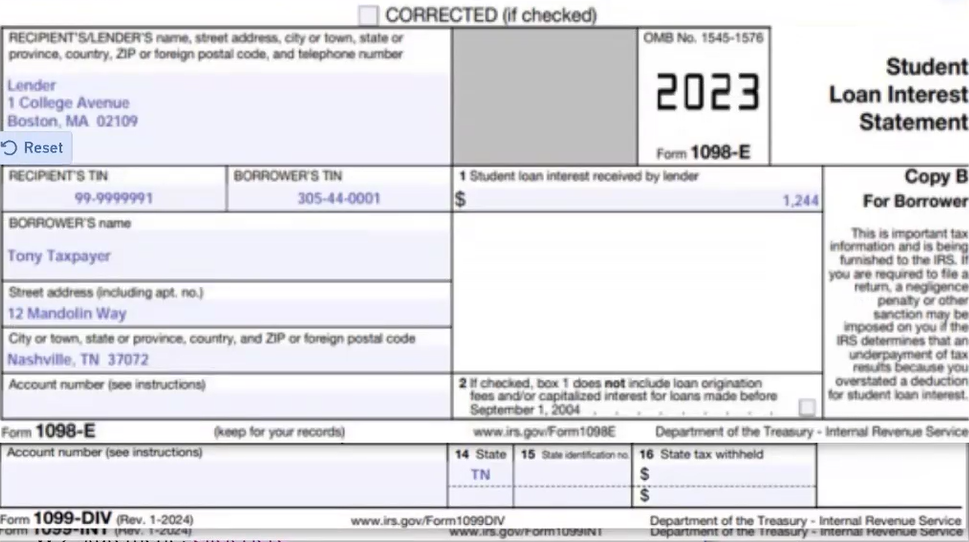

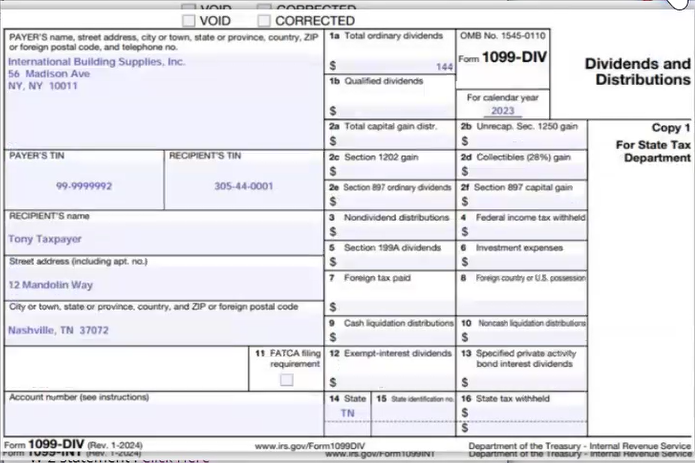

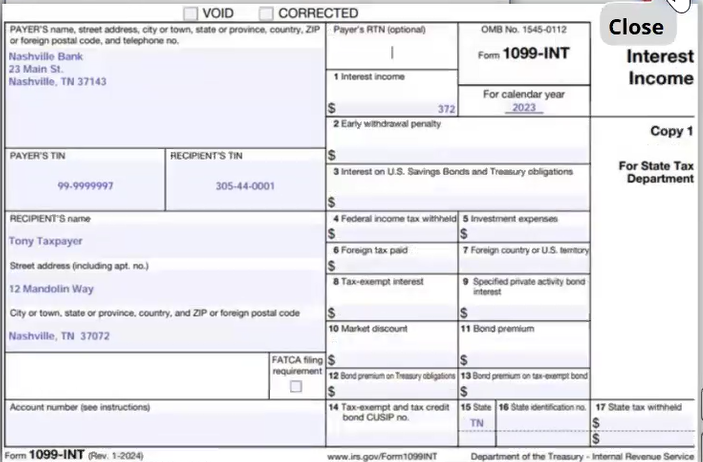

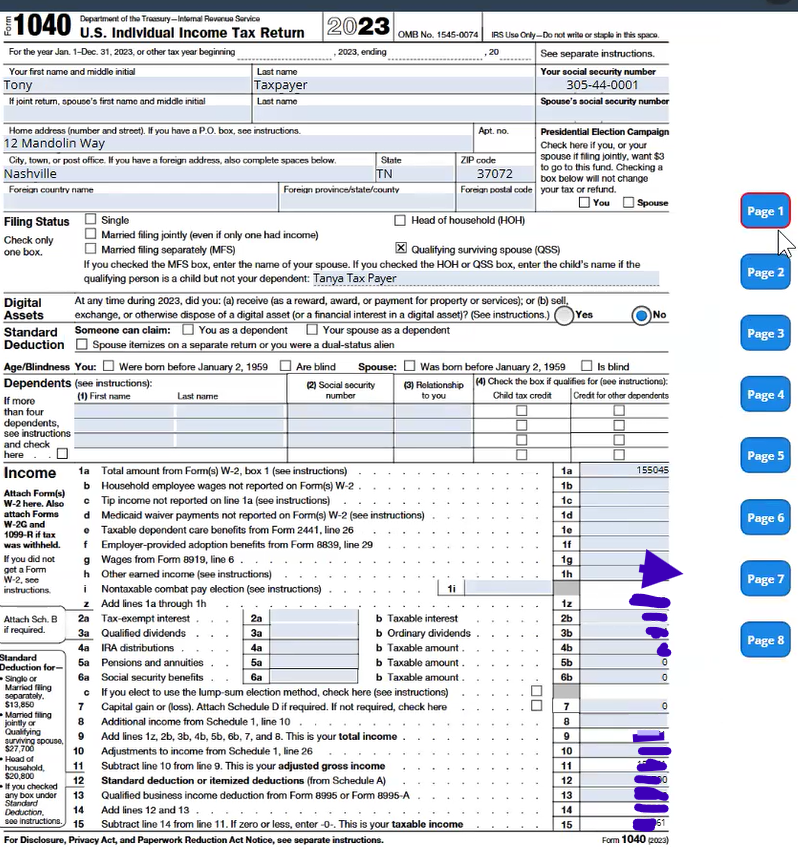

| Name | Tony Taxpayer | Greta Taxpayer | Tanya Taxpayer |

| Relationship | Husband, father | Wife, mother | Daughter |

| SSN | 305-44-0001 | 305-44-0002 | 305-44-0003 |

| DOB | 1/1/1984 | 2/2/1985 | 3/3/2013 |

| DOD | (Deceased, date of death: 05/05/2022) | ||

| Address | 12 Mandolin Way, Nashville, TN 37072 | ||

Tony is a widower who lives with daughter, Tanya, in a home he rents in Nashville, TN. His wife (and Tanya’s mother) died unexpectedly in 2022.

Tony works as a civil engineer, and also received interest and dividends as income in 2023. He has a High Deductible Family Health Plan, and contributes through his employer to a Family HSA. Tony did not have any HSA distributions in 2023.

Tony did not buy or sell any cryptocurrency. Tony does not wish to contribute to the Presidential Election Fund.

Tony pays for Tanya to attend a before and after school program while he works, and has provided the following information received from the program:

Inquisitive Minds Before and After School Program

Federal EIN 99-9999994

56 Grady Way

Nashville, TN 37072

2023 amount received for Tanya Taxpayer: $4,562

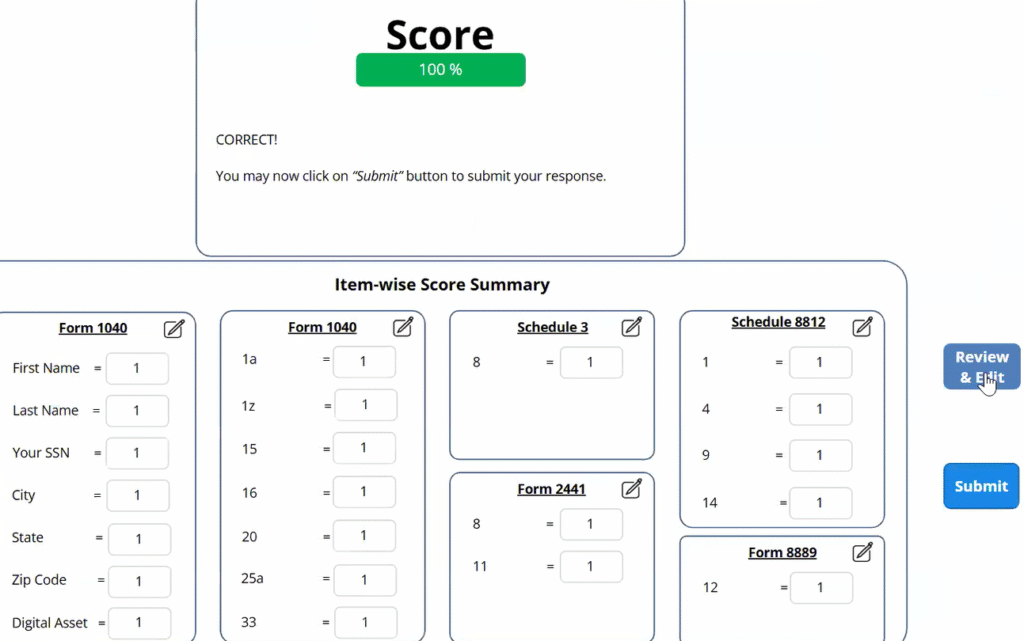

Solution – Tony is a widower who lives with daughter, Tanya

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

Purchased 6 Times

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.