TR 23.7 Jim & Dana Taxpayer

Task

File the tax returns based on Tax Scenario & Facts, Form W2, Form 1099-INT and SSA-1099 provided below.

Tax Scenario & Facts

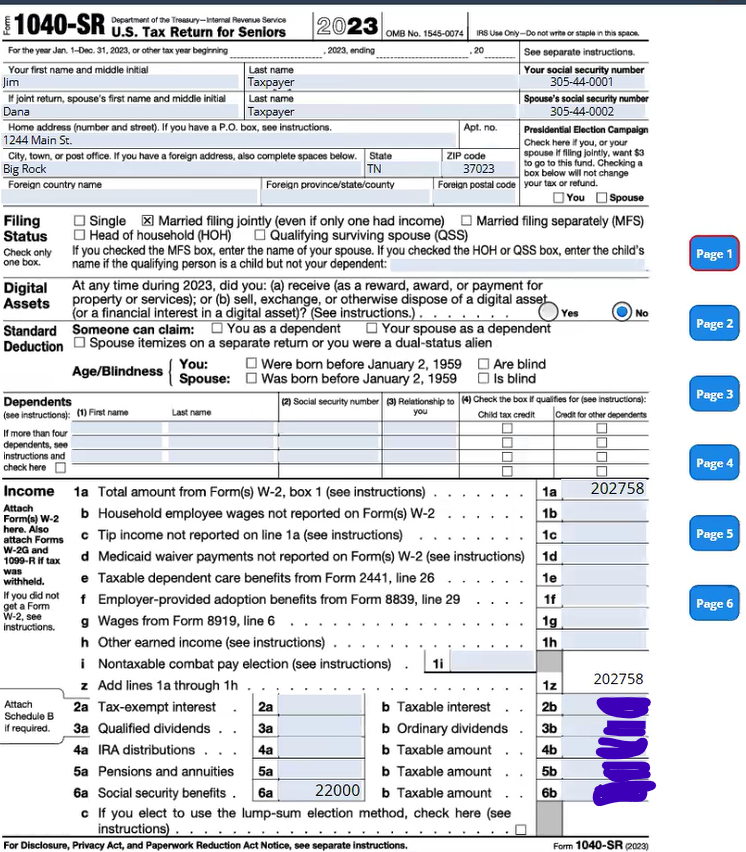

Jim and Dana Taxpayer are married and will file a joint tax return. Jim is an engineer and Dana is a librarian at her local Library. They live with their two granddaughters Laura and Jackie. Jim and Dana paid all their support in 2023.

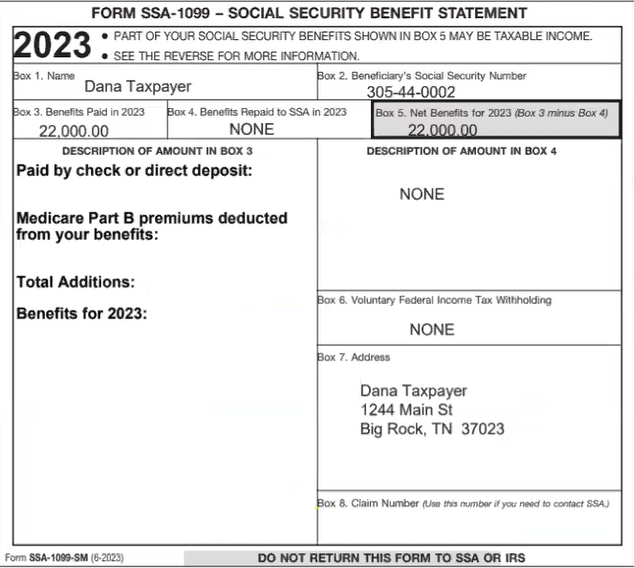

Dana worked part time, received a 1099-INT and collected $22,000 in Social Security in 2023.

Your assignment is to prepare Jim and Dana’s federal income tax return, Form 1040 for the year ending December 31, 2023. They reside at 1244 Main St. Big Rock, TN 37023.

| Jim | Dana | Jackie | Laura | |

| SSN | 305-44-0001 | 305-44-0002 | 305-44-0003 | 305-44-0004 |

| DOB | 2/14/1963 | 2/17/1953 | 4/24/2020 | 12/30/2023 |

Jackie’s social security number is not valid for employment. She was born overseas and lawfully admitted to the United States without work authorization from DHS and was issued a social security number not valid for employment to receive a federal benefit.

If any facts are missing please assume that they do not apply to the taxpayers.

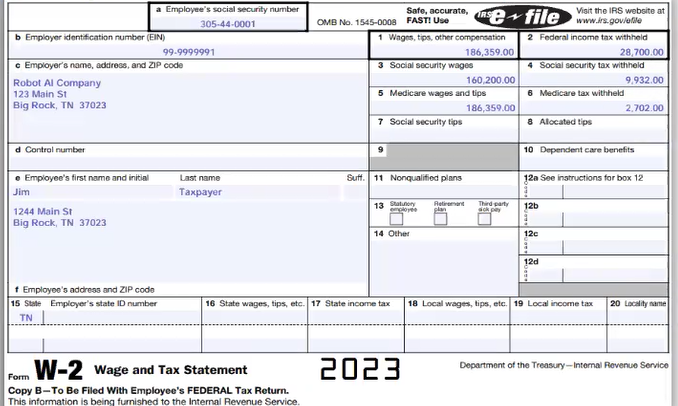

Form W-2 (Robot Al Company) : Click Here

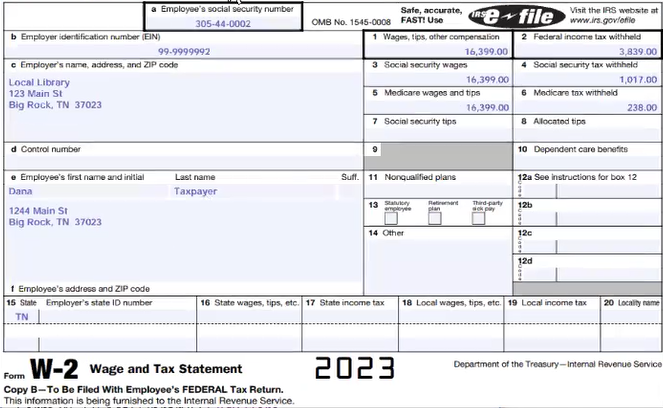

Form W-2 (Local Library) : Click Here

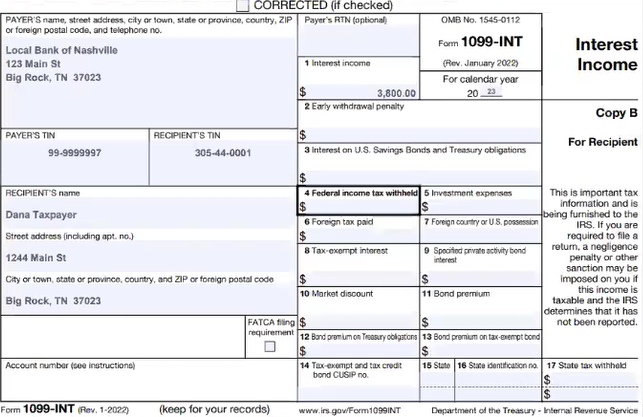

Form 1099-INT (Local Bank of Nashville) : Click Here

Form SSA-1099 : Click Here

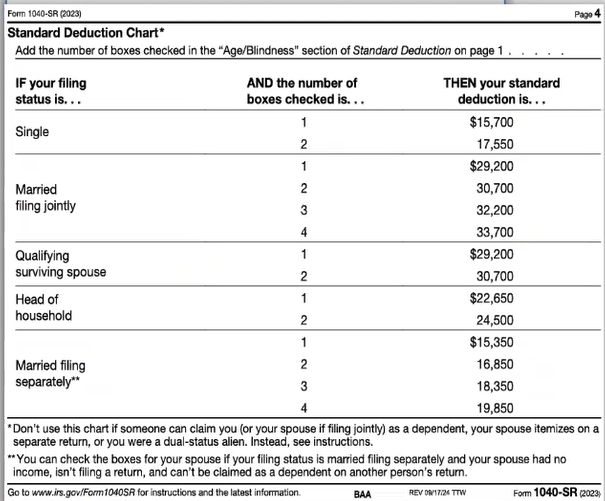

Standard Deduction Chart : Click Here

Helpful Links:

. https://www.irs.gov/

. https://www.irs.gov/pub/irs-prior/p17 — 2023.pdf

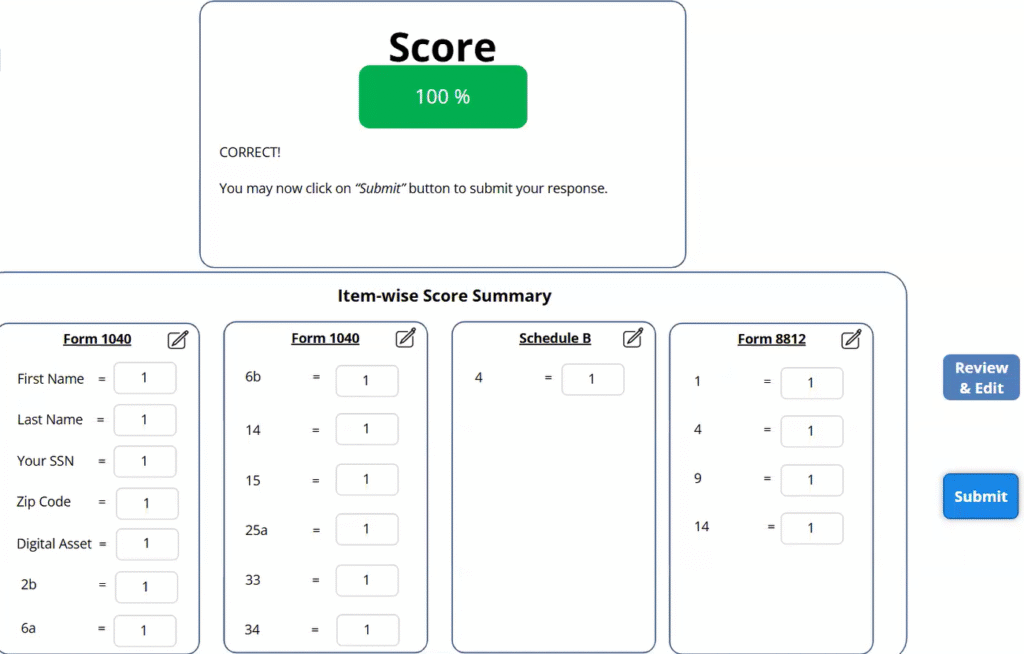

Solution – Jim and Dana Taxpayer are married and will file a joint tax return

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.