TR 23.6 Jim & Dana Taxpayer

Task

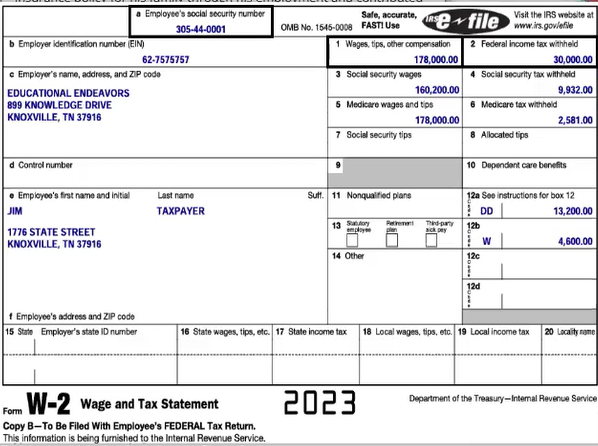

File the tax returns based on Tax Scenario & Facts. Form W2 provided below.

Tax Scenario & Facts

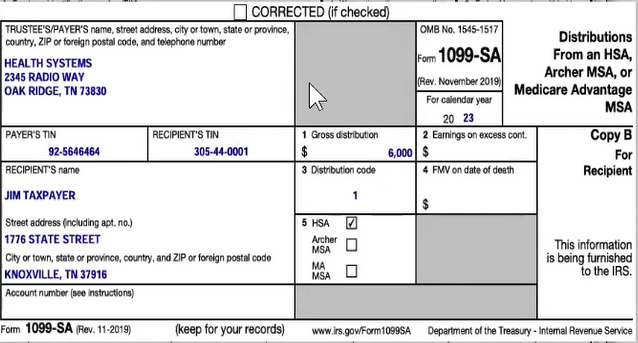

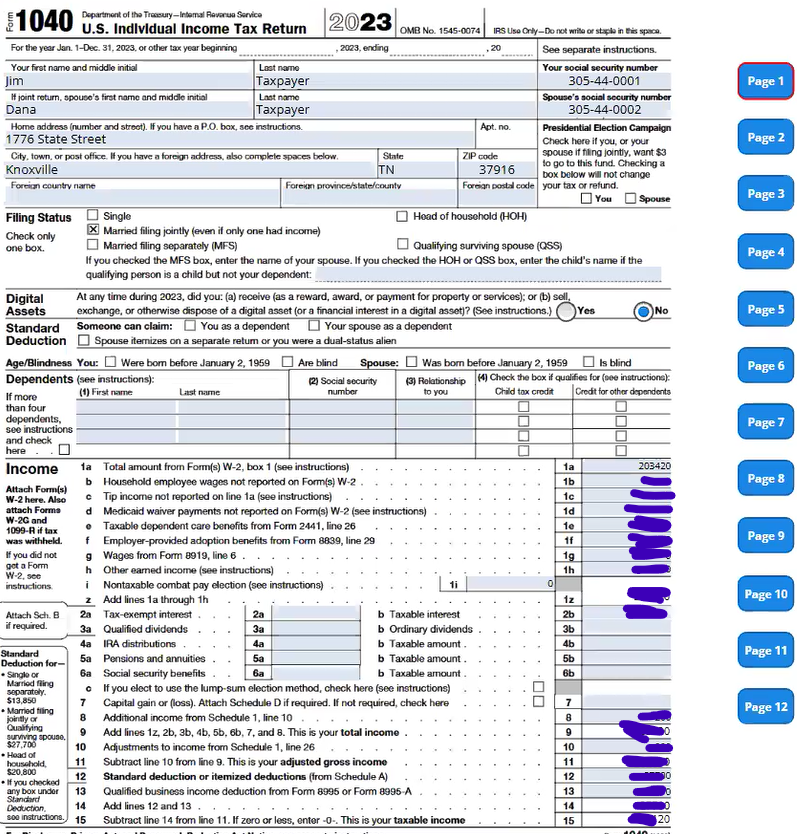

Jim Taxpayer needs you to prepare his 2023 1040 tax return. He is an elementary school teacher at Educational Endeavors, a private school in Tennessee. He is married to his wife Dana and they wish to file asmarried filing jointly. She is also an employee of Educational Endeavors and works as a cashier in the cafeteria. Jim has a high deductible health insurance policy for his family through his employment and contributed to his HSA through his employer and also $500 outside of his payroll deduction. They spent $6,000 out of the HSA funds. Only $200 out of the $6,000 was not spent on qualified medical expenses. They had no digital asset transactions during 2023.

The Taxpayers have one son named Hubert. They paid $5,000 to Educational Endeavors for daycare for Hubert.

Educational Endeavors Daycare

EIN # 38-9933667

899 KNOWLEDGE DRIVE

Knoxville, TN 37916

Also, in March of 2023 Dana’s mother Gladys could no longer be trusted

to live on her own and to Jim’s dismay began living with Jim and Dana.

Gladys is fully supported by Jim and Dana.

Jim used $500 of his own money to buy materials for his students.

Please help Jim and Dana by preparing their 2023 individual income tax

return based on this information along with the tax forms received.

| Name | SSN | DOB | Address |

| JIM Taxpayer | 305-44-0001 | 11/11/1974 | 1776 STATE STREET KNOXVILLE,TN 37916 |

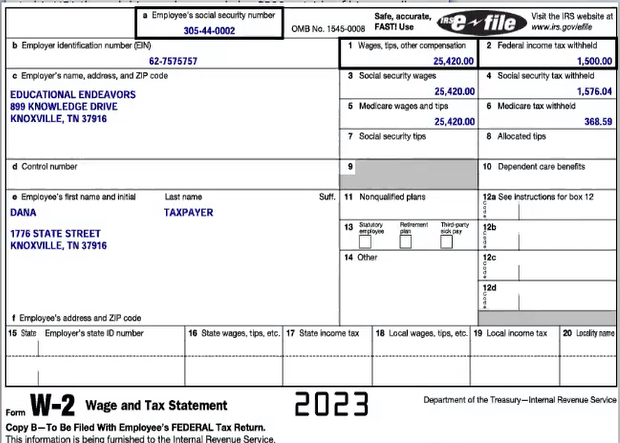

| DANA Taxpayer | 305-44-0002 | 4/12/1989 | |

| GLADYS SMITH | 305-44-0003 | 12/4/1947 | |

| HUBERT Taxpayer | 305-44-0004 | 12/15/2021 |

. W-2 statement (Dana) : Click Here

. W-2 statement (Jim) : Click Here

. 1099-SA : Click Here

1098-E : Click Here

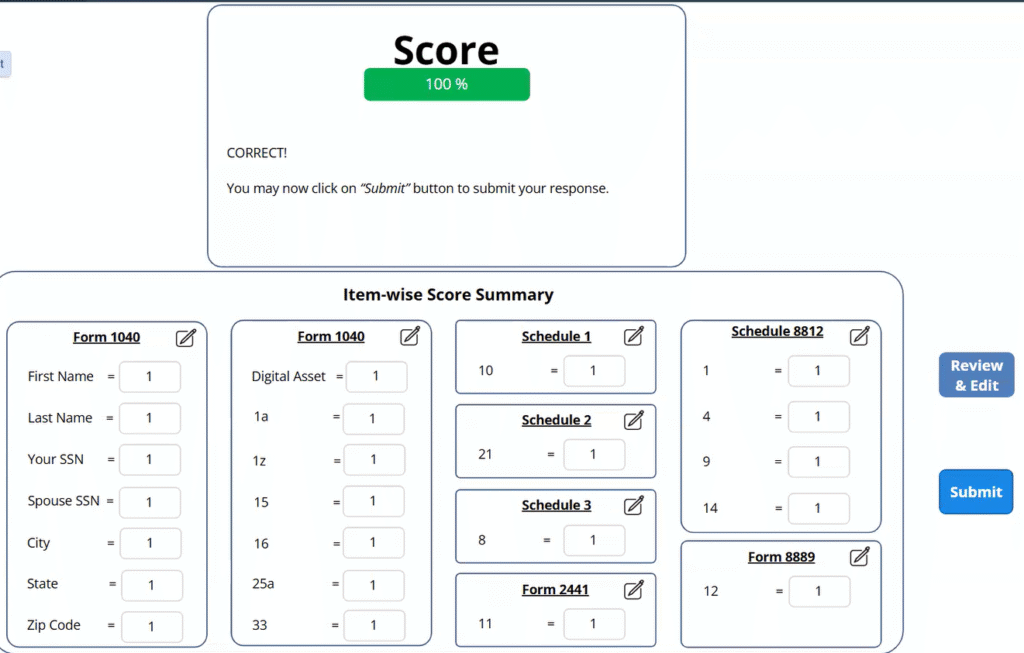

Solution – Jim Taxpayer needs you to prepare his 2023 1040 tax return

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

Purchased 14 times

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.