TR 23.13 Henry & Ruth Taxpayer

Task

File the tax returns based on Tax Scenario & Facts, Form W2 provided below.

Tax Scenario & Facts:

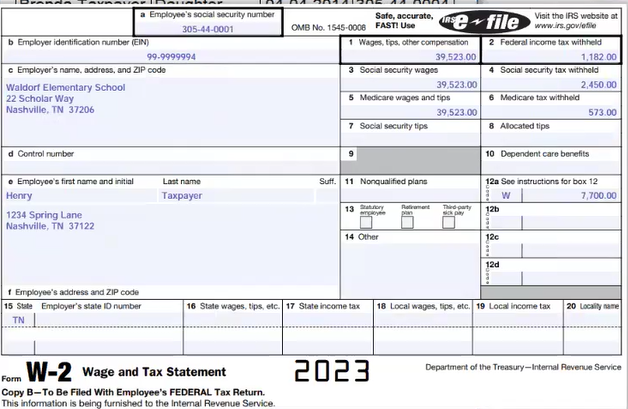

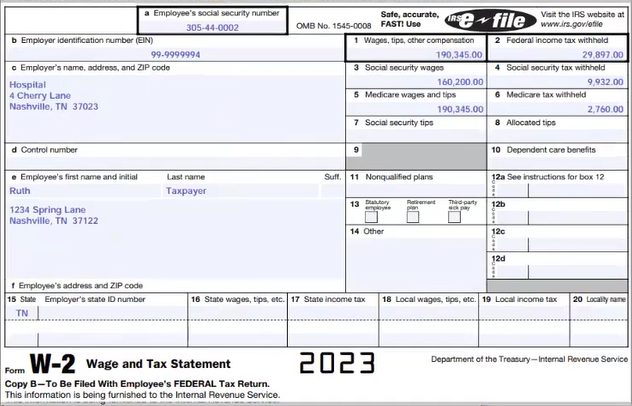

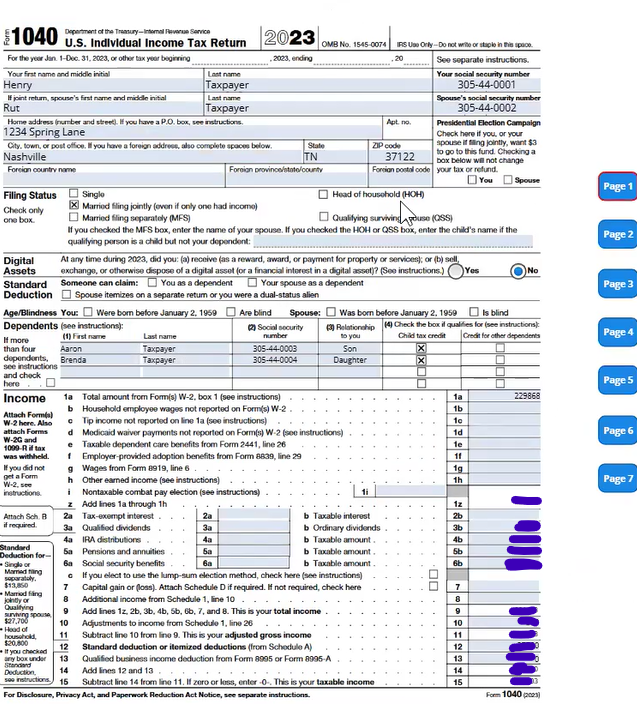

Henry & Ruth Taxpayer live in Nashville. TN with their two children. Henry is a teacher at a Waldorf school, and Ruth is a doctor. Henry has teacher expenses to deduct, and contributes to an HSA through his employer.

| Name | Relationship | DOB | SSN |

| Henry Taxpayer | Father | 1/1/1985 | 305-44-0001 |

| Ruth Taxpayer | Mother | 1/1/1990 | 305-44-0002 |

| Aaron Taxpayer | Son | 2/2/2013 | 305-44-0003 |

| Brenda Taxpayer | Daughter | 4/4/2014 | 305-44-0004 |

Henry & Ruth live with their children at 1234 Spring Lane, Nashville, TN 37122

- Henry & Ruth will take the standard deduction for their filing status.

- Henry has teacher expenses of $575.

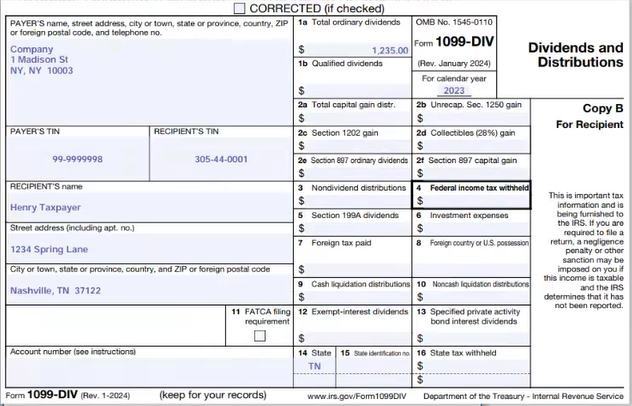

- Henry received dividends from stock purchased in January 2023.

- Henry has a high deductible health plan for his family through his employer. He contributes to an HSA through his employer and receives matching contributions.

- Henry Ruth did not own a foreign back account, and did not have a disaster distribution. They do not want to contribute to the presidential election campaign, and did not own or sell any crypto or digital assets.

Please assume anything not addressed above does not apply to this scenario.

W-2 statement (Waldorf) : Click Here

W-2 statement (Hospital): Click Here

1099-DIV (Company) : Click Here

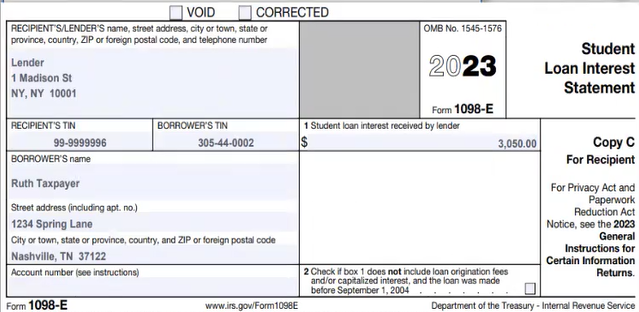

1098-E (Lender) : Click Here

Helpful Links:

https://www.irs.goV

https://www.irs.goV/pub/irs.prior/p17-2023.pdf

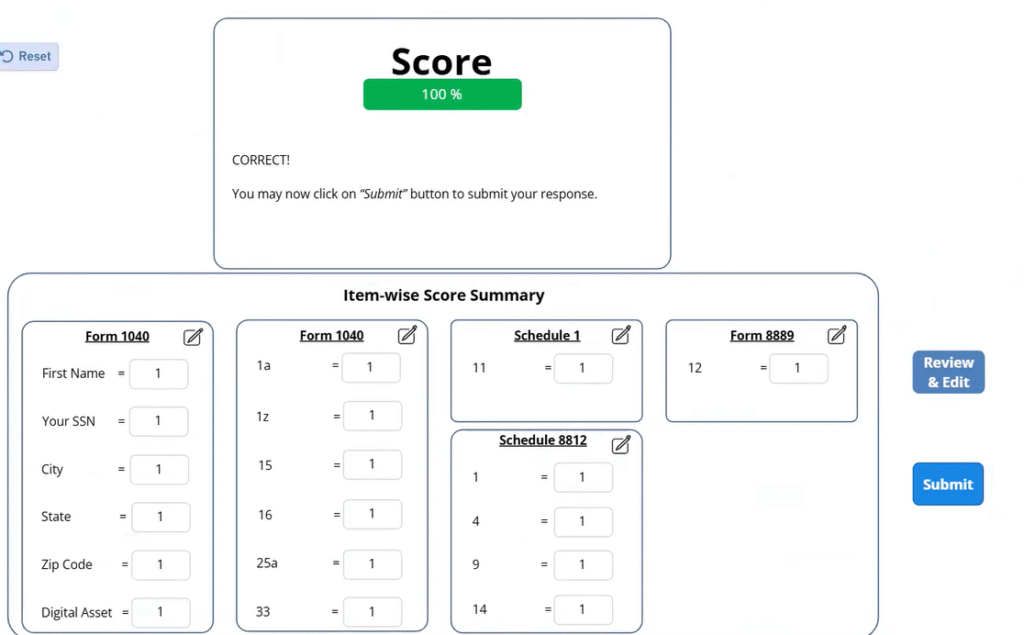

Solution – Henry & Ruth Taxpayer live in Nashville. TN with their two children.

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

Purchased 6 times

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.