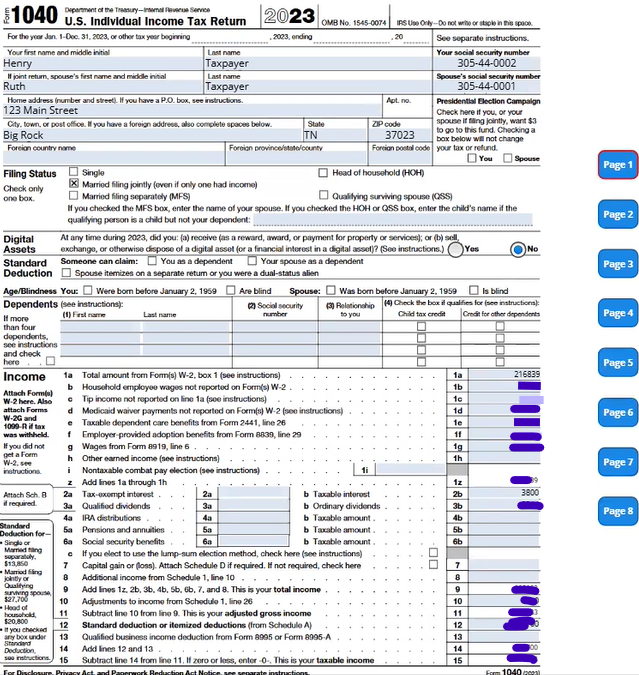

TR 23.11 Henry & Ruth Taxpayer

Task

File the tax returns based on Tax Scenario & Facts, Form W2 and 1098-T provided below.

Tax Scenario & Facts

| Taxpayer | Spouse | Dependent | |

| Name | Henry Taxpayer | Ruth Taxpayer | Amy Taxpayer |

| Marital Status | Married | Married | Single |

| SSN | 305-44-0002 | 305-44-0001 | 305-44-0003 |

| DOB | 5/11/1970 | 5/11/1975 | 1/1/2015 |

| Occupation | Construction worker | Manager | |

| Daytime Telephone | 903-575-0000 | ||

| Address | 123 Main Street, Big Rock, TN 37023. |

Taxpayers are Married and Filing a Joint return.

Taxpayer information:

- Taxpayer did not serve in the Military.

- The taxpayer lived in TN all year.

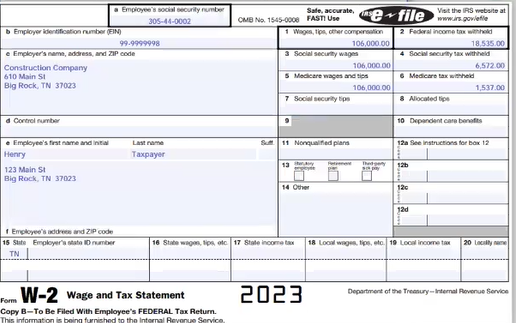

- Henry is a construction worker who made $106,000 in taxable income. No foreign assets or accounts, No crypto, did not have marketplace insurance.

Spouse information:

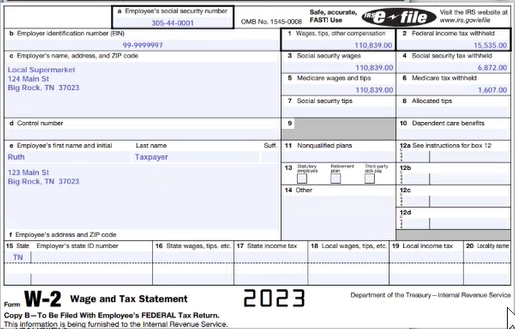

- . Ruth works at a local supermarket as a manager and made 110,839.

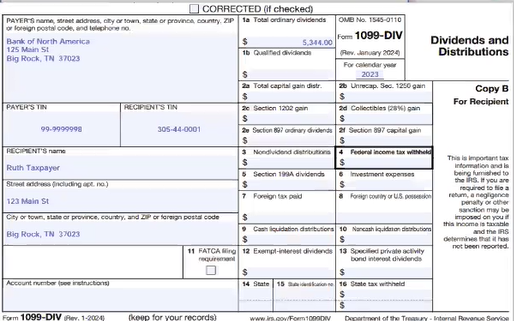

- . Ruth received Interest and dividend income.

Dependent information:

. They paid $6,000 for Amy’s before and after school care to:

Big Rock elementary school

824 Main St, Big Rock, TN 37023

EIN 99-99999991

. If any facts are missing, please assume they do not apply to the taxpayers.

. W-2 (Construction Company) : Click Here

. W-2 (Local Supermarket) : Click Here

. 1099-INT : Click Here

. 1099-DIV : Click Here

Helpful Links:

. https://www.irs.gov/

. https://www.irs.gov/pub/irs-prior/p17 — 2023.pdf

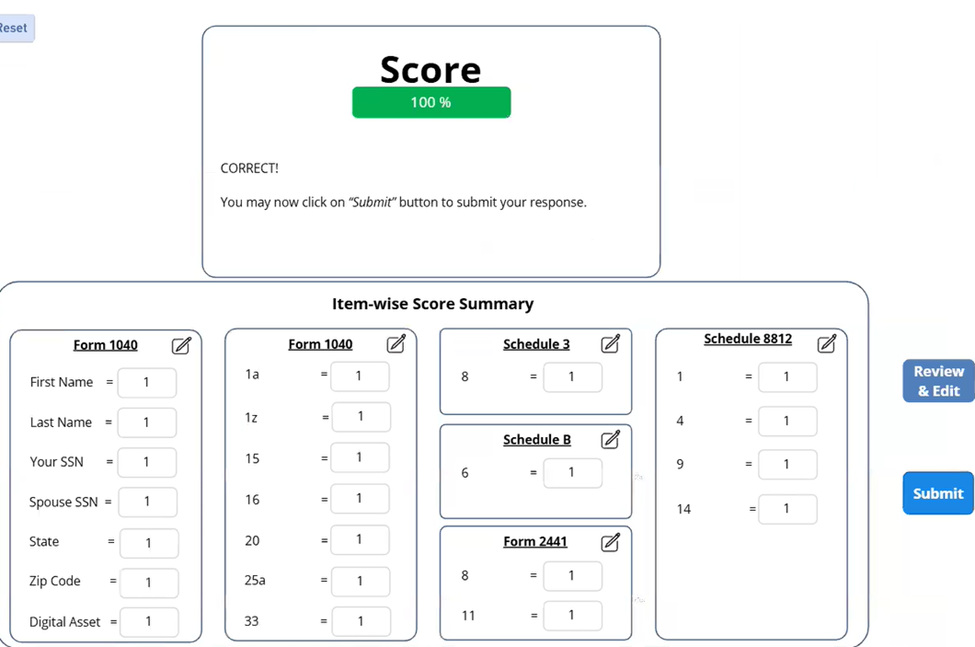

Solution

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.