Tax Scenario & Facts – Jane Taxpayer

Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return. She is a nuclear physicist at a private research facility in Tennessee. She is married to her husband Leroy and they wish to file married filing separately.

Jane has two children from a previous relationship. Both children live with her. Her son Clayton was born 11/13/2017. Her daughter Daisy was born 05/09/2003 and is finally a senior in high school hoping to graduate in 2024. Daisy made $8,952 in 2023 from her YouTube channel, however Jane provided more than half of her living expenses.

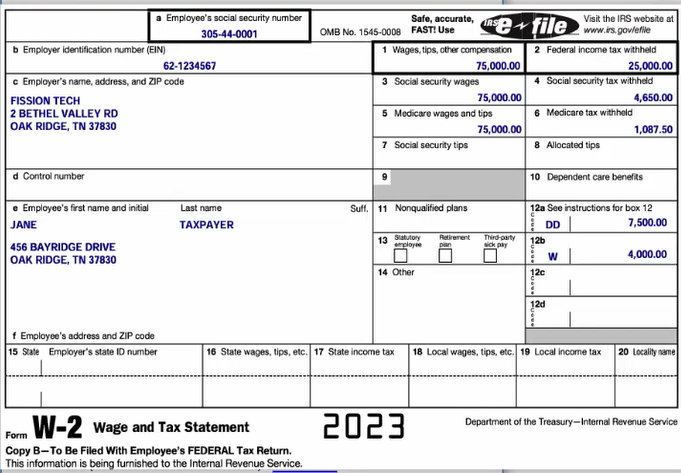

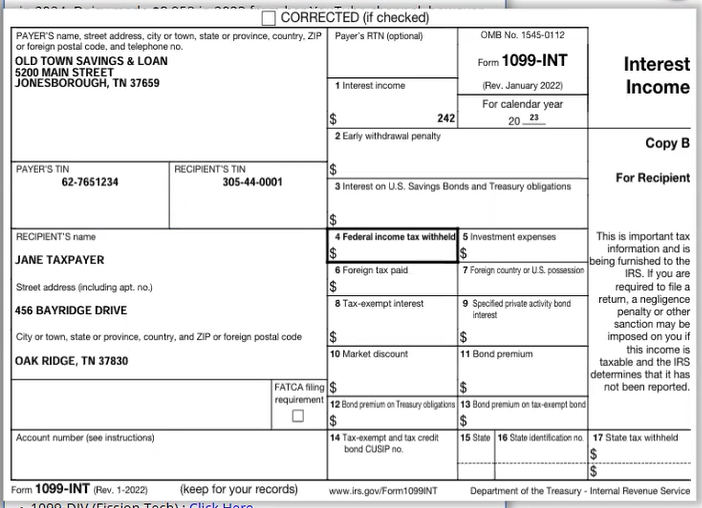

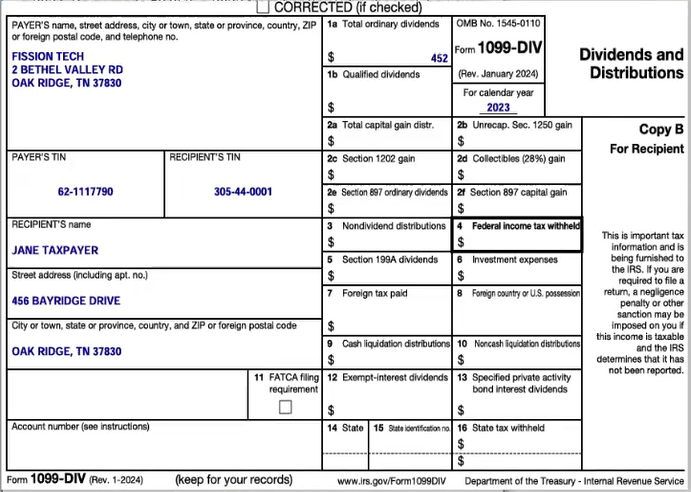

Jane received a W2 from her job at Fission Tech. Jane also received some dividends and interest. Through her employer she has a high deductible health insurance plan for her family, and has an HSA at the end of 2023.

She used $4,000 from the HSA during 2023 for medical expenses. Jane had no digital asset transactions during 2023. Please help Jane by preparing her 2023 individual income tax return based on this

information along with her personal information below as well as the tax forms she received. Be sure to reference the Married Filing Separately “Special Rules” listed in the 2023 IRS Pub 17 for additional info regarding credits or deductions this status may or may not qualify for:

https://www.irs.gov/pub/irs-prior/p17 — 2023.pdf, page 23, 3rd column.

| Name | SSN | DOB | Address |

| Jane Taxpayer | 305-44-0001 | 01-04-1975 | 456 Bayridge |

| Leroy Taxpayer | 305-44-0002 | Drive | |

| Clayton Taxpayer | 305-44-0003 | OAK RIDGE, TN. | |

| Daisy Taxpayer | 305-44-0004 | 37830 |

- W-2 statement : Click Here

- 1099-INT : Click Here

- 1099-DIV (The Business Consultants) : Click Here

- 1099-DIV (Fission Tech) : Click Here

- 1099-SA : Click Here

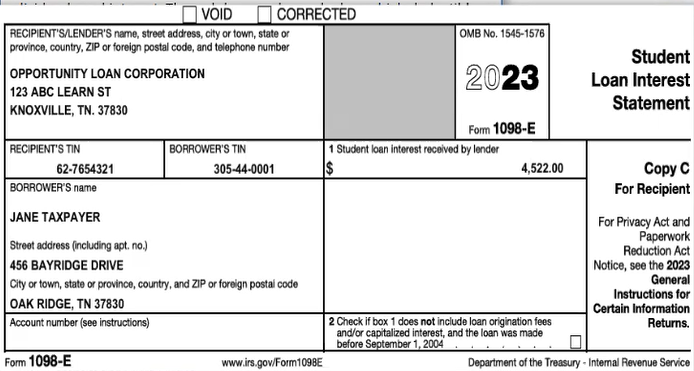

- 1098-E : Click Here

1099 – INT – Interest Income

1099 – Div

1

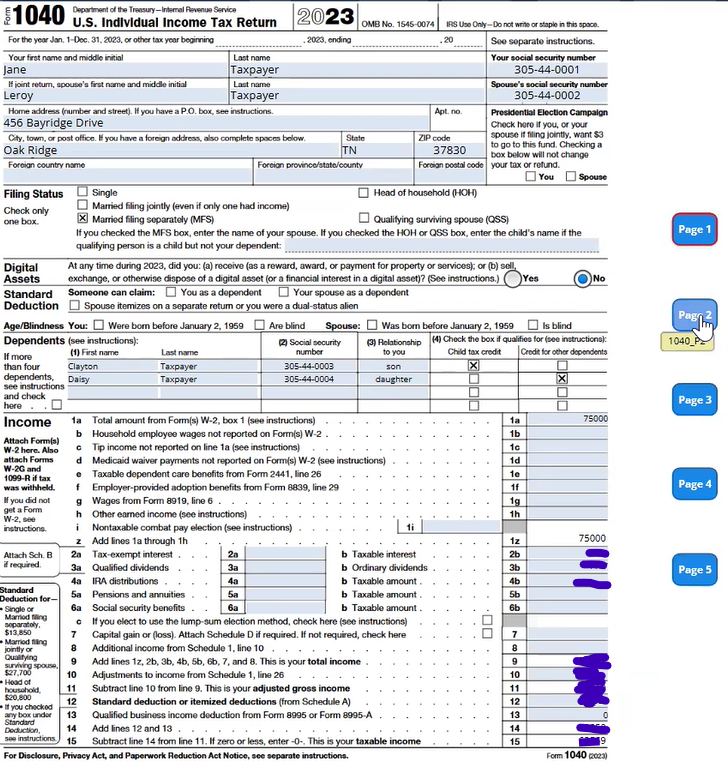

Solution – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Below is a snippet of the correct answer fior Jane tax paper tax filing for year 2023.

.

Please click on the Icon below to purchase the FULL ANSWER at only $19.99

.

.

See Related Solutions

Buy (Solved) Full 13 Intuit Practice Tax Returns

Tax return 1 – Solved – Julie Taxpayer is store clerk at a small gift store in Nashville

Tax return 2 – 100% Correct Solved – Jane Taxpayer needs you to prepare her 2023 1040 tax return tax return

Tax return 3 – TR 23.3 Ruth Taxpayer Tax Scenario & Facts

Tax return 4 – Solved – Meet Ruth Taxpayer. She is a loan officer at Sticks and Stones Lending

Tax return 5 – Solved – Juan and Maria Taxpayer are a retired couple who live in Nashville

Tax return 6 – Solved – TR 23.6 Jim Taxpayer needs you to prepare his 2023 1040 tax return

Tax return 7 – (Solved) Jim and Dana Taxpayer are married and will file a joint tax return

Tax return 8 – (Solved) Meet Jane Taxpayer. Jane is retired and enjoying life in Miami, FL

Tax return 9 – (Solved) Tony is a widower who lives with daughter, Tanya

Tax return 10 – Solved – Jennifer Taxpayer needs you to prepare her 2023 1040 tax return

Tax return 11 – Solved – TR 23.11 Henry & Ruth Taxpayer – Taxpayers are Married and Filing a Joint return.

Tax return 12 – Solved – Meet Dana Taxpayer. Dana is a middle school teacher in Knoxville, TN

Tax return 13 – Solved – TR 23.13 Henry & Ruth Taxpayer live in Nashville. TN with their two children.